Stablecoin Market Cap

Stablecoin Market Cap: Your Guide to Understanding the Crypto Lifeline

If you've spent any time in the cryptocurrency space, you've definitely heard the term "stablecoin." These digital assets are fundamental to the crypto ecosystem, acting as the bridge between traditional fiat currency and volatile digital assets. But what does their size tell us about the broader market?

Today, we're diving deep into the concept of the Stablecoin Market Cap. Think of this metric not just as a number, but as a critical indicator of liquidity, trust, and the overall health of decentralized finance (DeFi). Understanding this cap is key to making informed decisions in the world of crypto.

We'll explore what makes this metric tick, who the major players are, and why its movement affects every investor, trader, and crypto enthusiast.

What Exactly is the Stablecoin Market Cap?

In simple terms, the Stablecoin Market Cap represents the total dollar value of all stablecoins currently in circulation. Since stablecoins are generally pegged 1:1 to a reserve asset, usually the US Dollar, calculating this market cap is straightforward.

Unlike Bitcoin or Ethereum, whose market caps fluctuate based on price volatility, the growth of the Stablecoin Market Cap is primarily driven by issuance. When a stablecoin issuer mints a new coin, the market cap increases by the value of that coin.

A growing market cap for stablecoins suggests increasing demand for liquidity within the crypto space. It means more users are holding onto stable assets, ready to deploy capital into trading, lending, or decentralized applications.

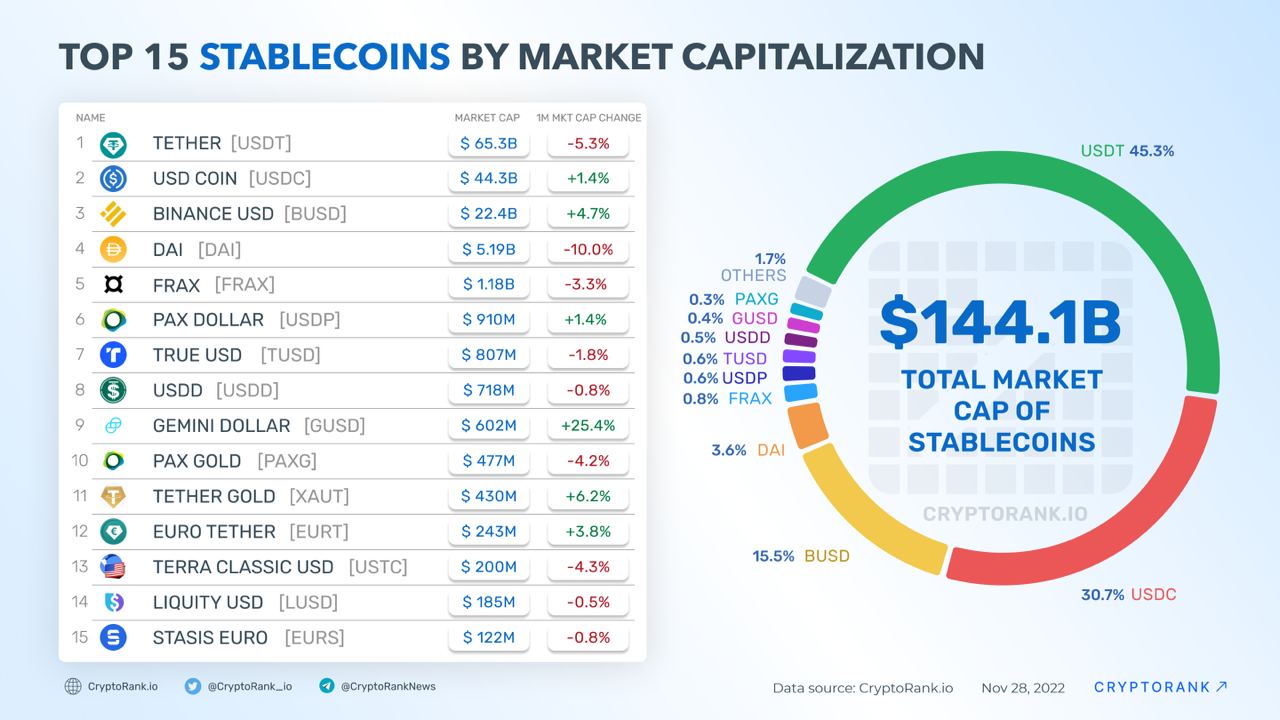

The Big Players: Dominating the Stablecoin Market Cap Ranking

The vast majority of the total Stablecoin Market Cap is held by just a handful of major players. These companies manage huge reserves and are responsible for the smooth operation of cross-exchange trading and DeFi activities globally.

Tether (USDT) and USD Coin (USDC) are the undisputed giants. They command significant influence, and any movement in their individual market caps can heavily influence the overall crypto landscape.

We also see strong competition from newer entrants and smaller, regionally focused stablecoins. However, for now, the stability and established use cases of USDT and USDC keep them firmly at the top of the Stablecoin Market Cap leaderboard.

Why Does the Stablecoin Market Cap Matter to You?

As an investor, you should pay close attention to the Stablecoin Market Cap for several reasons. It acts as a barometer for market sentiment and future potential.

When the overall cap grows, it often signals that fresh capital is entering the crypto ecosystem, sitting on the sidelines ready to purchase Bitcoin, Ethereum, or altcoins. Conversely, a rapidly shrinking cap might indicate capital outflows, suggesting investors are redeeming their stablecoins for fiat.

Furthermore, the size of the stablecoin pool directly impacts market liquidity. Higher liquidity means easier and faster execution of large trades without causing significant price impact, which is crucial for institutional participation.

Key Factors Influencing the Stablecoin Market Cap Growth

What drives billions of dollars into stablecoins? It's not just trading activity. A confluence of factors, ranging from technological advancements to global economic conditions, contribute to the expansion of the total Stablecoin Market Cap.

One primary driver is the growth of Decentralized Finance (DeFi). Stablecoins are the foundational currency of DeFi lending, borrowing, and yield farming protocols. As these sectors mature, the demand for stable, predictable collateral increases.

Another major factor is global adoption, particularly in emerging markets where stablecoins offer a reliable hedge against local currency inflation and provide fast, cross-border payment solutions.

Analyzing the Dynamics: Supply vs. Demand

Stablecoins operate under a crucial supply-demand mechanism. When users want more stablecoins, they deposit fiat with the issuer (like Circle or Tether), and new coins are minted, increasing the supply and the overall Stablecoin Market Cap.

Conversely, when users want to exit crypto entirely, they redeem their stablecoins for fiat, and the coins are burned. This action reduces the supply and subsequently decreases the Stablecoin Market Cap.

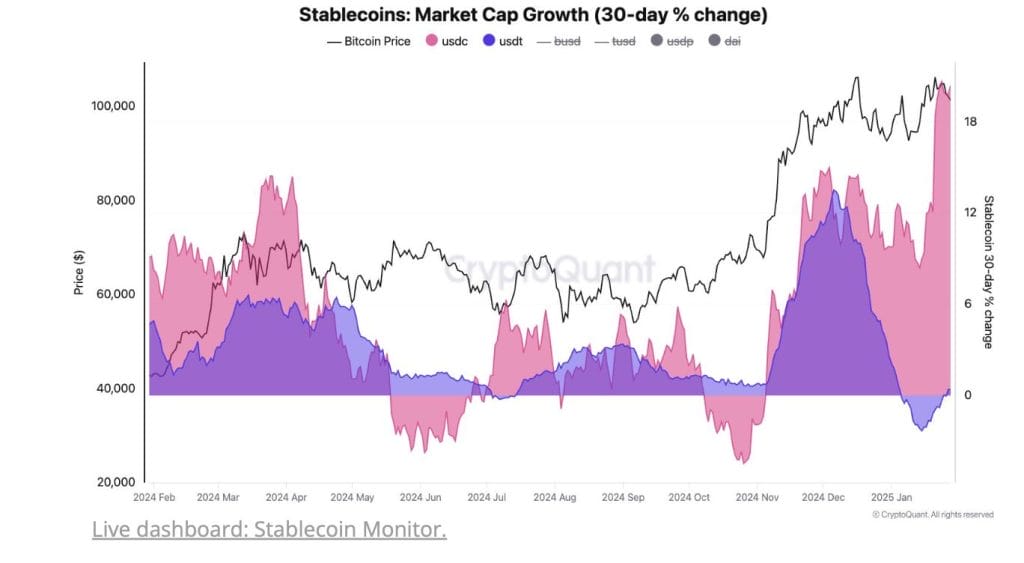

Monitoring the rate of minting versus burning provides valuable insight into whether institutional and retail investors are accumulating or distributing assets. Rapid minting often precedes bull market activity.

The key drivers of stablecoin demand include:

- Cross-Border Payments: Lower transaction fees and faster settlement times compared to traditional banking wires.

- Yield Generation: Utilizing stablecoins in DeFi platforms to earn passive income through lending or liquidity provision.

- Market Hedging: A quick way for traders to exit volatile positions during a downturn without leaving the crypto ecosystem entirely.

- Institutional Integration: Banks and financial firms using stablecoins for efficient settlement between institutions.

Regulatory Impacts and Future Outlook

Regulation is perhaps the most significant unknown factor affecting the future of the Stablecoin Market Cap. Governments globally are recognizing the sheer size and importance of these assets, leading to increased scrutiny.

Major legislative efforts, such as the EU's MiCA regulation or potential bills in the US, aim to impose strict reserve requirements and audit standards on stablecoin issuers. This is generally a positive development, as it increases transparency and investor confidence.

However, overly burdensome regulation could stifle innovation or make stablecoin issuance less profitable, potentially slowing down the growth of the Stablecoin Market Cap. We are moving toward a period where only highly compliant, well-reserved stablecoins will likely thrive.

In the coming years, we might see the market diversify. While fiat-backed stablecoins will remain dominant, algorithmic stablecoins that have proven their resilience, and potentially new centralized bank digital currencies (CBDCs), could shift the total composition of the Stablecoin Market Cap.

How to Track the Stablecoin Market Cap

Tracking this metric is surprisingly easy thanks to the transparent nature of blockchain data. You don't need complicated formulas; reliable crypto data websites do the heavy lifting for you.

When you monitor the charts, pay attention to the trend over the last 90 days. Is the cap increasing steadily, or are there sharp spikes indicating massive minting events? These patterns can hint at institutional movement or significant market shifts.

Don't just look at the total number; also track the dominance ratio. For example, if USDT's share of the total Stablecoin Market Cap is shrinking while USDC's share is growing, it suggests a preference shift among users towards stablecoins perceived as more compliant or audited.

- Check reputable crypto data aggregators daily.

- Analyze the percentage change in the market cap week-over-week.

- Monitor the reserve audits and transparency reports published by major stablecoin issuers.

- Pay attention to global regulatory announcements, as they have an outsized impact on this specific crypto niche.

Conclusion: The Steadfast Cornerstone of Crypto

The Stablecoin Market Cap is much more than a footnote in crypto statistics; it's the bedrock of the decentralized economy. It reflects the global demand for instant liquidity, secure payment rails, and a reliable anchor in the volatile crypto ocean.

As the crypto industry matures and institutional adoption continues, we expect the overall Stablecoin Market Cap to continue its upward trajectory, albeit with inevitable short-term fluctuations tied to regulatory clarity and macroeconomic conditions.

Keeping an eye on this critical metric provides crucial foresight into the health, readiness, and future direction of the entire cryptocurrency market. It truly is the unsung hero of the digital asset world.

Frequently Asked Questions (FAQ) about Stablecoin Market Cap

- What is the current Stablecoin Market Cap?

- The current Stablecoin Market Cap is a constantly changing figure, but it typically fluctuates in the hundreds of billions of US dollars. You should consult a real-time crypto data tracker for the precise, up-to-the-minute number.

- Why does Tether (USDT) usually have the largest Stablecoin Market Cap?

- Tether has historically been the first and most widely adopted stablecoin, especially popular on non-US exchanges and in high-volume trading pairs. Its early mover advantage and widespread integration across trading platforms contribute to its market dominance.

- Does the Stablecoin Market Cap include algorithmic stablecoins?

- Generally, yes, the total Stablecoin Market Cap calculation includes both fiat-backed (like USDT and USDC) and algorithmic stablecoins (like DAI). However, due to past stability concerns, major trackers sometimes categorize them separately based on their reserve mechanism.

- How does a decreasing Stablecoin Market Cap affect the price of Bitcoin?

- A significant decrease often indicates that capital is being redeemed back into fiat currency, reducing the immediate liquidity available to purchase volatile assets like Bitcoin. This can sometimes precede or coincide with bear market conditions, as investors seek to exit the ecosystem.

Stablecoin Market Cap

Stablecoin Market Cap Wallpapers

Collection of stablecoin market cap wallpapers for your desktop and mobile devices.

Exquisite Stablecoin Market Cap Background Digital Art

This gorgeous stablecoin market cap photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing Stablecoin Market Cap Abstract Art

Discover an amazing stablecoin market cap background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Mesmerizing Stablecoin Market Cap Scene Photography

Transform your screen with this vivid stablecoin market cap artwork, a true masterpiece of digital design.

Dynamic Stablecoin Market Cap Scene Art

A captivating stablecoin market cap scene that brings tranquility and beauty to any device.

Serene Stablecoin Market Cap Wallpaper Collection

Experience the crisp clarity of this stunning stablecoin market cap image, available in high resolution for all your screens.

Captivating Stablecoin Market Cap Design Nature

Immerse yourself in the stunning details of this beautiful stablecoin market cap wallpaper, designed for a captivating visual experience.

Detailed Stablecoin Market Cap Design Concept

Transform your screen with this vivid stablecoin market cap artwork, a true masterpiece of digital design.

Lush Stablecoin Market Cap Picture Concept

Immerse yourself in the stunning details of this beautiful stablecoin market cap wallpaper, designed for a captivating visual experience.

Breathtaking Stablecoin Market Cap Image for Your Screen

Experience the crisp clarity of this stunning stablecoin market cap image, available in high resolution for all your screens.

Exquisite Stablecoin Market Cap Background for Your Screen

Immerse yourself in the stunning details of this beautiful stablecoin market cap wallpaper, designed for a captivating visual experience.

Exquisite Stablecoin Market Cap Design in 4K

Find inspiration with this unique stablecoin market cap illustration, crafted to provide a fresh look for your background.

Exquisite Stablecoin Market Cap Picture Concept

A captivating stablecoin market cap scene that brings tranquility and beauty to any device.

Dynamic Stablecoin Market Cap View Collection

This gorgeous stablecoin market cap photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Crisp Stablecoin Market Cap Wallpaper for Your Screen

Immerse yourself in the stunning details of this beautiful stablecoin market cap wallpaper, designed for a captivating visual experience.

Gorgeous Stablecoin Market Cap Photo Digital Art

Find inspiration with this unique stablecoin market cap illustration, crafted to provide a fresh look for your background.

Artistic Stablecoin Market Cap View Collection

Find inspiration with this unique stablecoin market cap illustration, crafted to provide a fresh look for your background.

High-Quality Stablecoin Market Cap Design Digital Art

Discover an amazing stablecoin market cap background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp Stablecoin Market Cap Photo Nature

This gorgeous stablecoin market cap photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Dynamic Stablecoin Market Cap Picture Illustration

This gorgeous stablecoin market cap photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Gorgeous Stablecoin Market Cap Design Concept

Immerse yourself in the stunning details of this beautiful stablecoin market cap wallpaper, designed for a captivating visual experience.

Download these stablecoin market cap wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Stablecoin Market Cap"

Post a Comment