Stablecoins By Market Cap

Stablecoins By Market Cap: Understanding the Giants and the Newcomers

Welcome to the world of crypto, where volatility reigns supreme—except for one crucial corner: stablecoins. These digital assets are designed to maintain a stable value, typically pegged 1:1 to a fiat currency like the US Dollar. But just like traditional finance, not all stablecoins are created equal.

If you want to understand the health and structure of the cryptocurrency market, tracking Stablecoins By Market Cap is absolutely essential. It tells us who the major players are, where the liquidity flows, and, critically, which assets the market trusts the most for value storage and transactional speed.

Ready to dive deep into the numbers and meet the heavyweights of the stablecoin universe? Let's break down why market capitalization is the ultimate scoreboard in this critical sector.

Why Tracking Stablecoins By Market Cap Matters

When we talk about market capitalization, we are simply referring to the total value of all coins currently in circulation. For stablecoins, this figure is a direct indicator of the total dollar reserves backing that digital asset. A larger market cap generally suggests greater adoption and utility.

Think of market cap as a measure of institutional confidence. If large financial players or major exchanges trust a specific stablecoin, they will hold and transact massive amounts of it, naturally driving up its market cap. This size often correlates directly with the coin's reliability and backing transparency.

The Stability Factor

The entire purpose of a stablecoin is stability. But how do we gauge which ones are genuinely stable? While their peg should ideally always be $1, massive market fluctuations can test this peg. A large market cap acts as a psychological and financial buffer against minor deviations.

Coins with higher market capitalization often have substantial and diversified collateral reserves, making it easier for issuers to maintain the dollar peg even during extreme market events. If the market cap suddenly dips significantly, it could signal concerns about the underlying reserves or regulatory pressures.

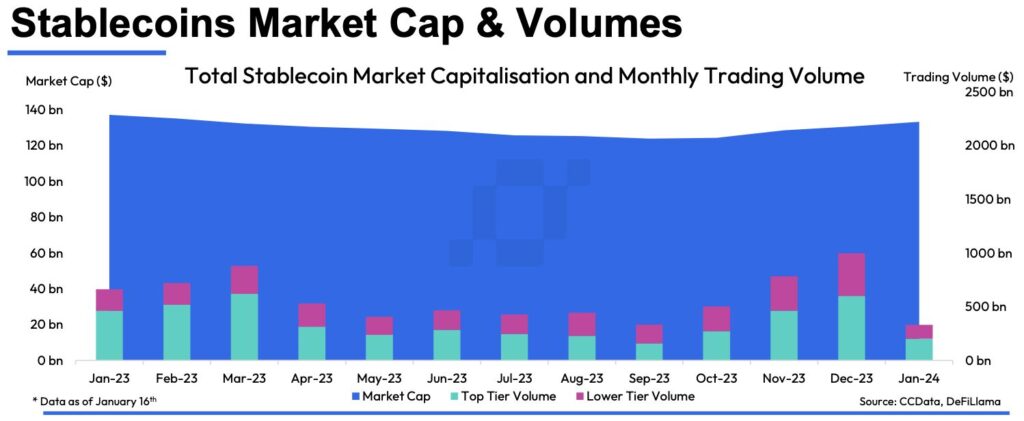

Liquidity and Trading Volume

Liquidity is arguably the most crucial feature of any stablecoin. If you need to move millions quickly without moving the price, you need deep liquidity. Stablecoins with high rankings in Stablecoins By Market Cap usually boast incredible liquidity.

These are the coins used as the primary trading pairs on nearly every major exchange globally. High market cap ensures minimal slippage and instant conversion between fiat, crypto, and other stable assets. This is why institutional traders rarely look past the top two or three stablecoins.

Here's what high liquidity means for you:

- Faster and cheaper trades across exchanges.

- Reliable collateral for decentralized finance (DeFi) protocols.

- Lower risk of the coin temporarily losing its $1 peg during massive sell-offs.

The Dominant Players in the Stablecoin Arena

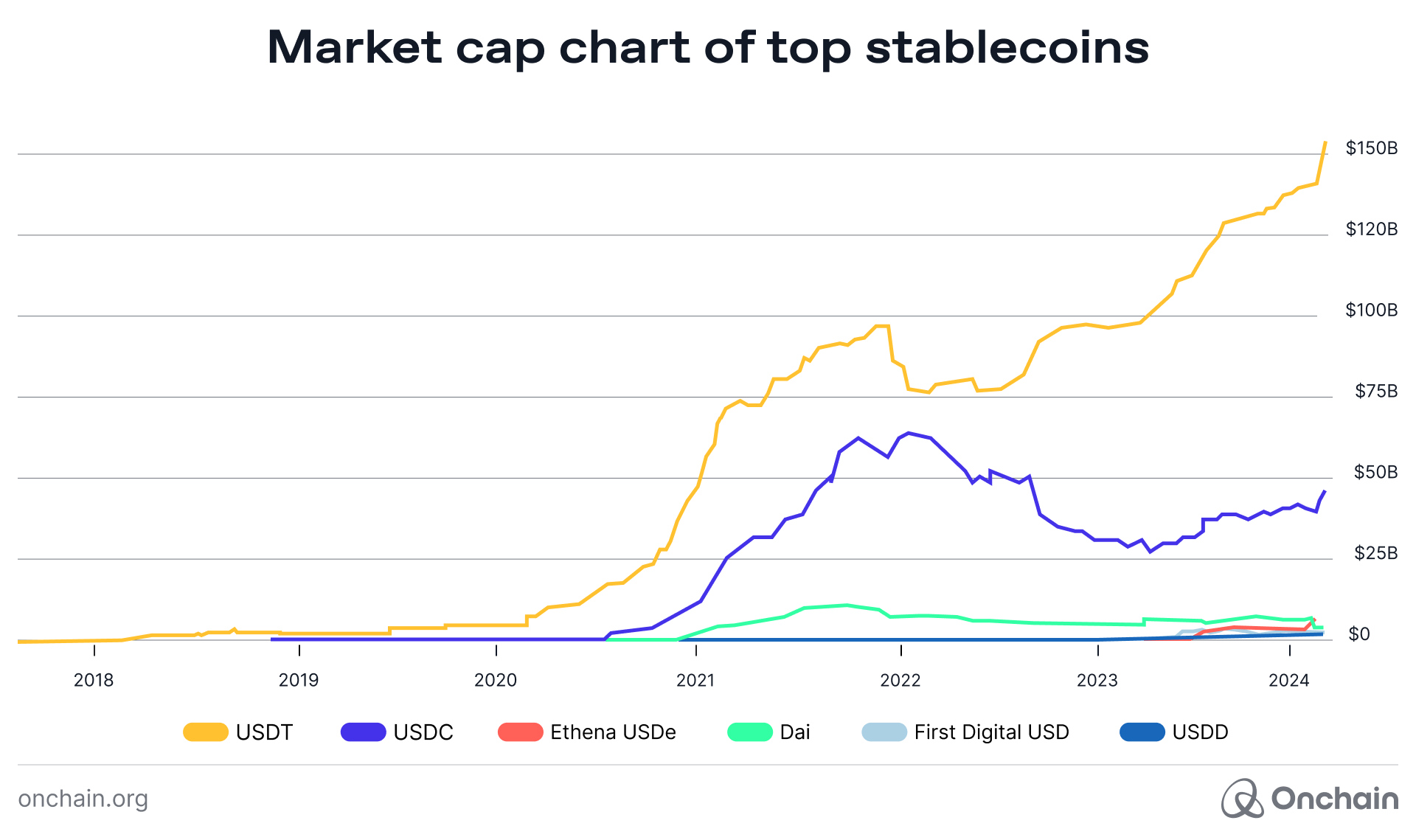

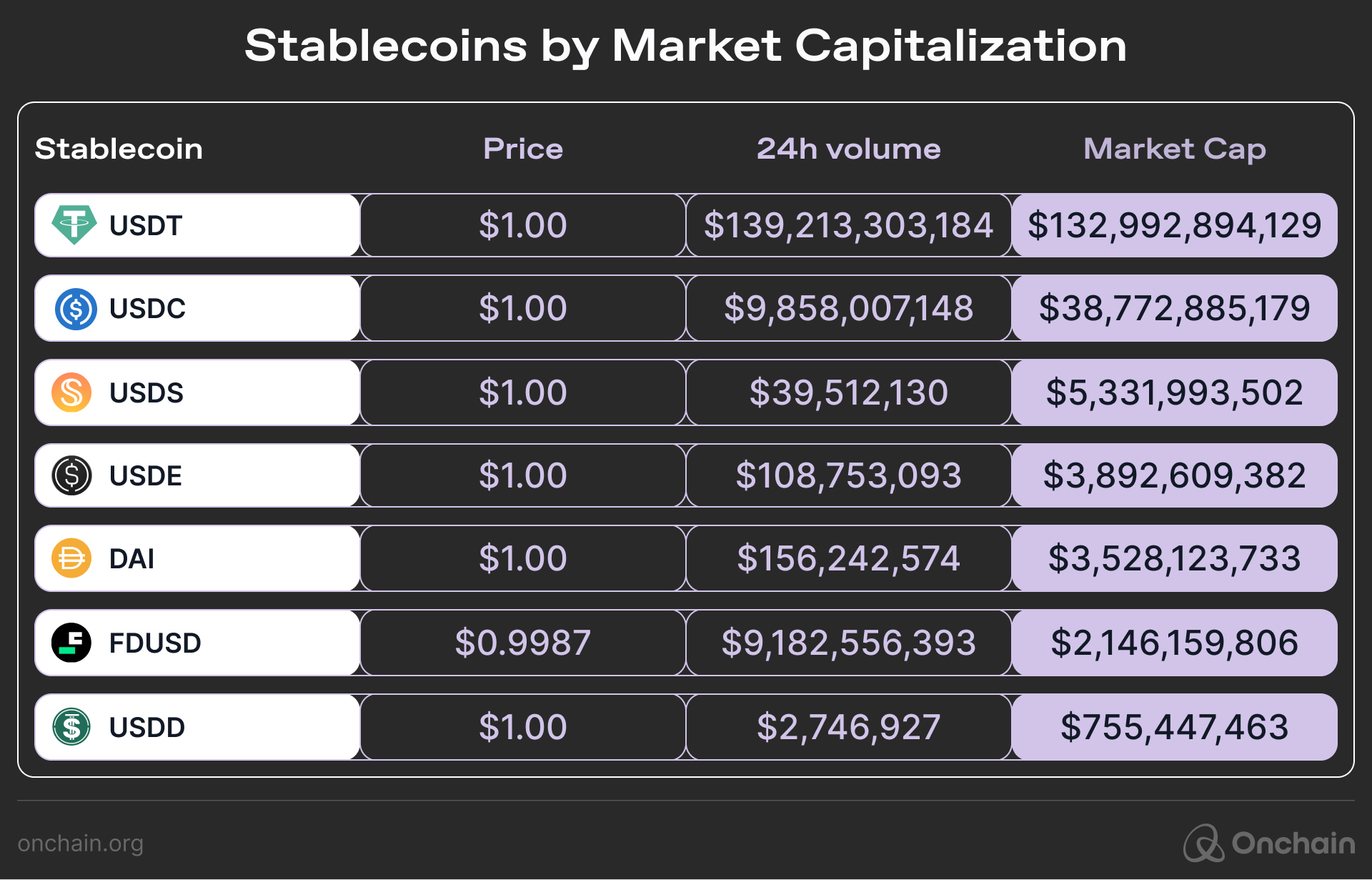

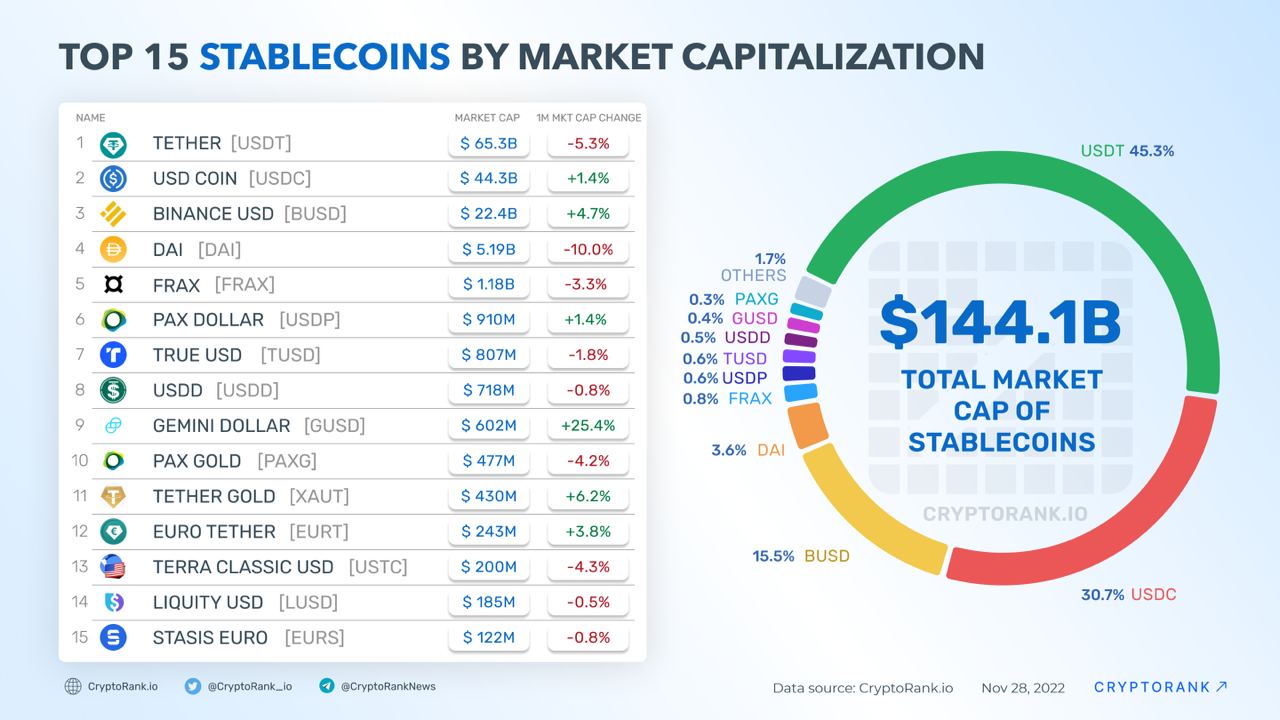

The stablecoin ecosystem is often described as a duopoly, dominated by two massive titans that control the vast majority of the total market capitalization. Their sheer size is often intimidating to newcomers, but understanding their differences is vital.

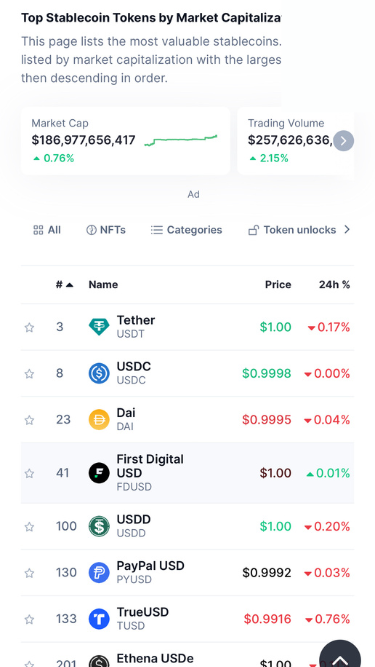

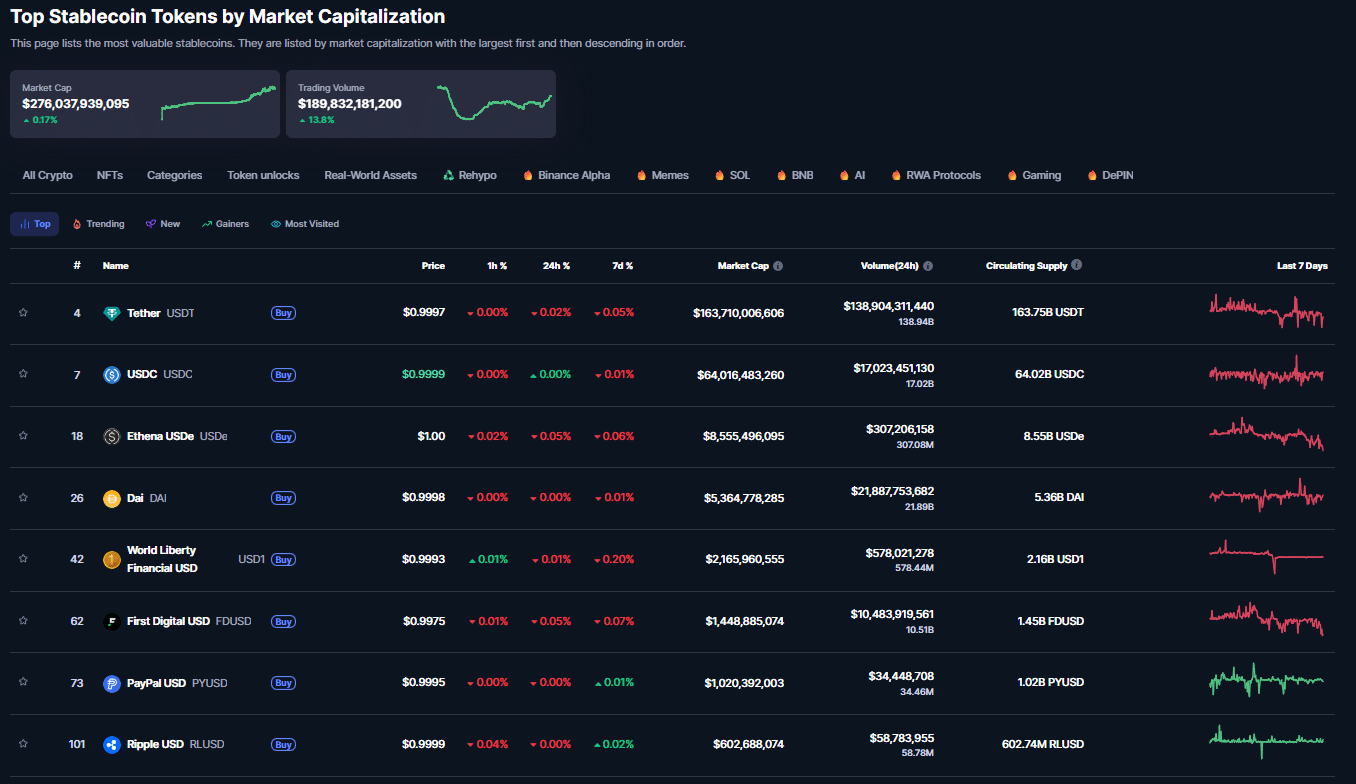

Tether (USDT): The Undisputed Leader

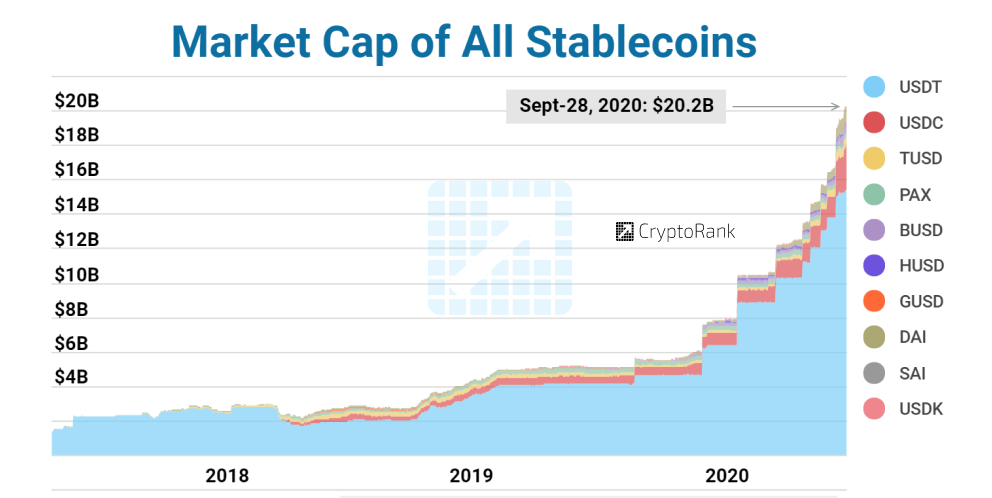

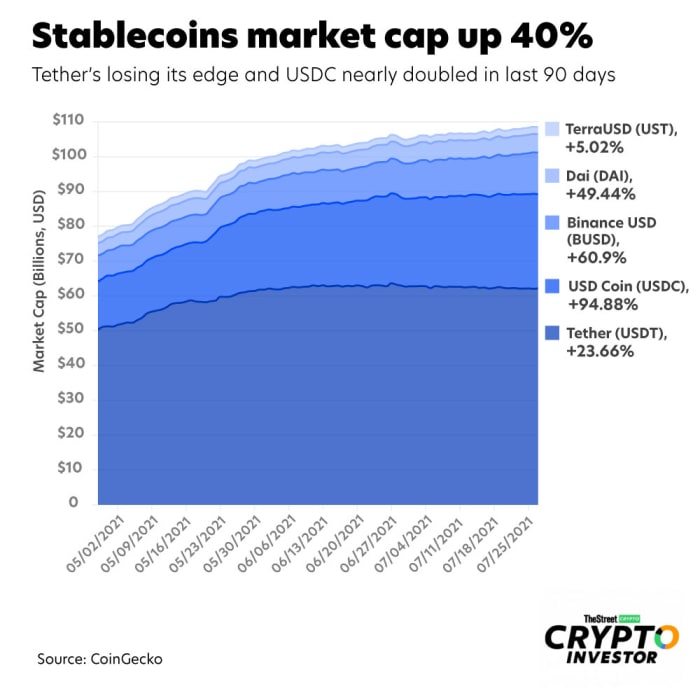

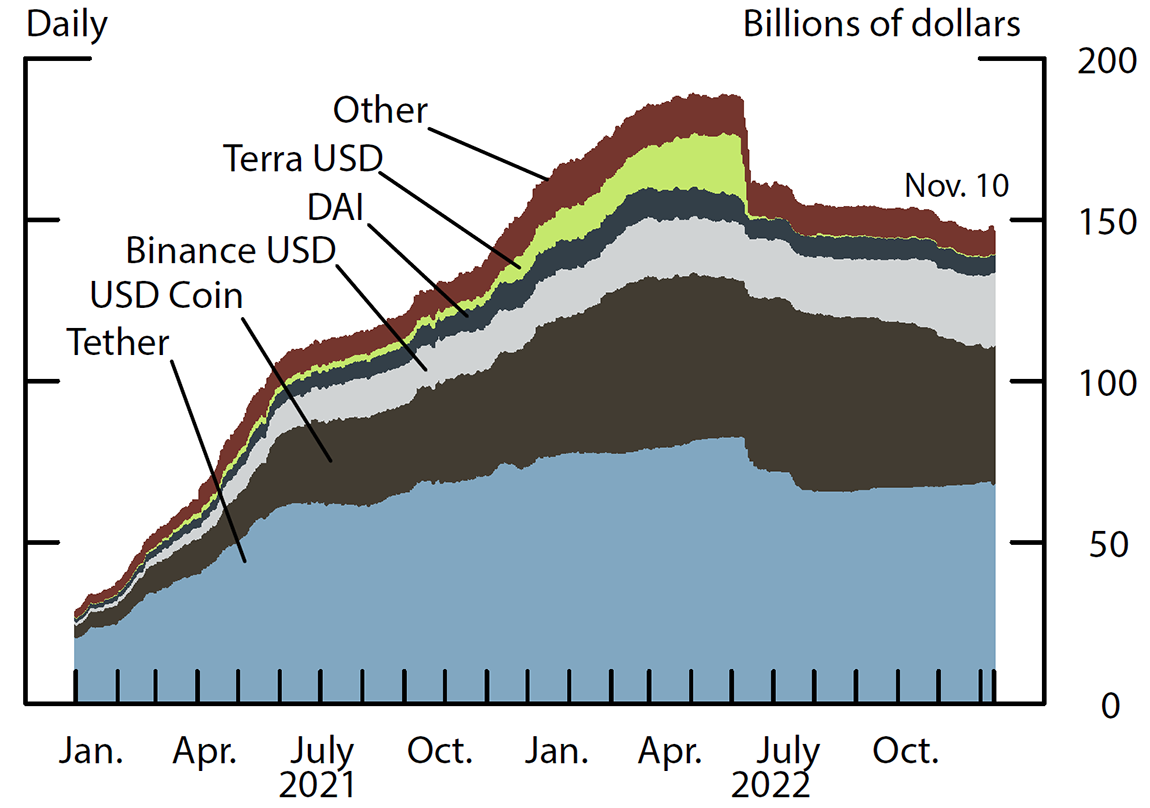

Tether, or USDT, consistently holds the top spot when ranking Stablecoins By Market Cap. It was one of the first stablecoins, launching in 2014, and has maintained its lead primarily due to its early adoption and widespread availability on almost every crypto exchange in the world.

USDT's massive market cap makes it the go-to asset for traders needing rapid movement between different jurisdictions and exchanges, especially those with stringent banking regulations. Despite historical controversy regarding the composition of its reserves, Tether has significantly improved its transparency and reporting over recent years, bolstering its dominance.

USD Coin (USDC): The Regulatory Favorite

USD Coin, or USDC, is the challenger. Issued by Circle and Coinbase (through the Centre consortium), USDC is known for its rigorous regulatory compliance and monthly attestations showing that its reserves are held primarily in cash and short-term US Treasury bonds.

While USDT often wins on sheer volume and market cap size, USDC appeals deeply to institutional investors and businesses prioritizing transparency and regulatory comfort. Its steady growth has solidified its position as the clear runner-up, often gaining ground when confidence wavers in its primary competitor. For users focusing on compliance and safety, USDC is often the stablecoin of choice.

Emerging Competitors and Niche Stablecoins

Beyond the top two, the stablecoin landscape is diverse, featuring options focusing on decentralization, specific blockchain ecosystems, or unique collateral mechanisms. While their market caps are smaller, they play vital roles in supporting niche ecosystems, especially in decentralized finance (DeFi).

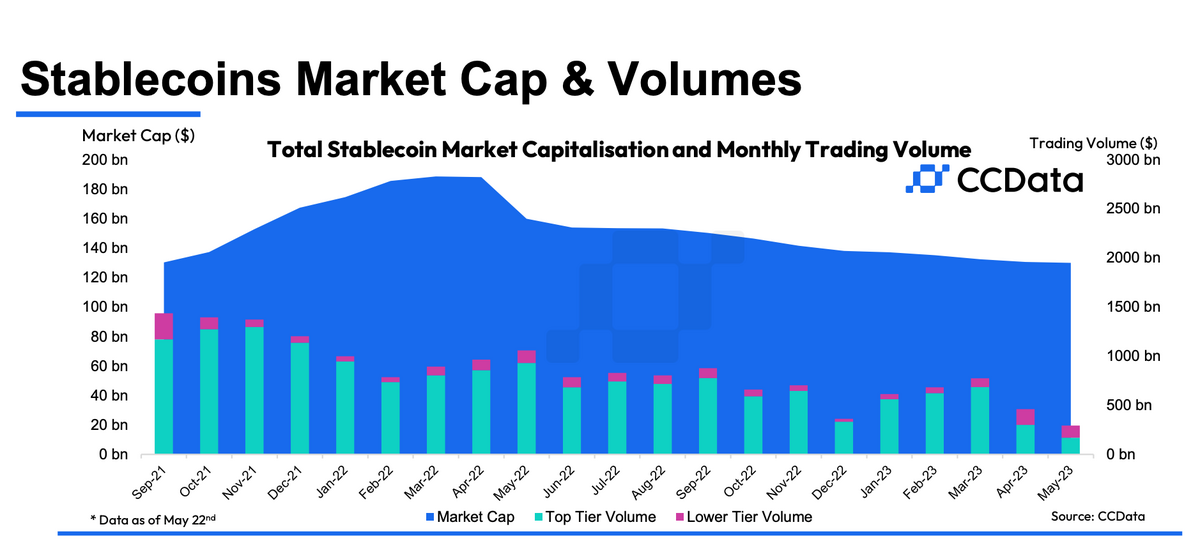

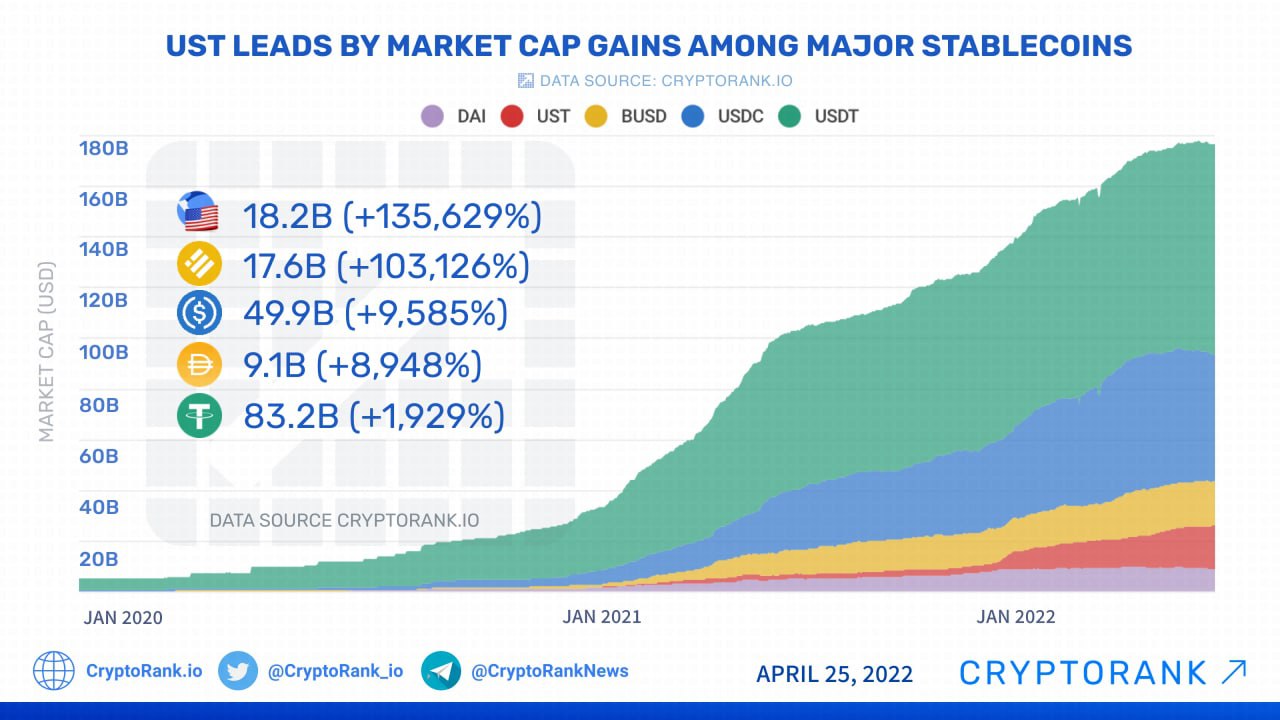

For example, while BUSD (Binance USD) was once a major player, regulatory actions have seen its market cap significantly decline, illustrating how quickly the ranking of Stablecoins By Market Cap can change due to external factors.

Decentralized Options: The Rise of DAI

DAI is one of the most interesting decentralized stablecoins, backed by a mix of other cryptocurrencies (collateralized debt positions) and governed by the MakerDAO community. DAI's market cap, while much smaller than USDT or USDC, is highly significant because it represents a genuinely decentralized monetary policy.

Users who prioritize censorship resistance and independence from centralized corporate issuers often turn to DAI. Its mechanisms are transparent, managed via smart contracts, making it a cornerstone asset within the Ethereum DeFi ecosystem. It offers a crucial alternative for those wary of corporate control over their digital dollars.

Algorithmic Stablecoins: A Historical Note

Historically, there have been several attempts to create stablecoins backed entirely by algorithms, without reliance on physical dollar reserves. These projects aimed to achieve true decentralization through programmatic minting and burning mechanisms.

However, the rapid and catastrophic failure of several high-profile algorithmic models has cast a long shadow. These failures demonstrated that while ingenious, purely algorithmic backing mechanisms are vulnerable to rapid market crashes and severe lack of confidence. The stability required to climb the Stablecoins By Market Cap ladder usually necessitates tangible asset backing.

Future Trends Shaping Stablecoin Market Cap

The stablecoin market is not static. Its future market cap distribution will be heavily influenced by two major factors: regulation and the rise of Central Bank Digital Currencies (CBDCs).

Governments worldwide are paying close attention to stablecoins, viewing them as systemic financial infrastructure. Upcoming regulations, such as MiCA in Europe or potential federal frameworks in the US, will likely demand higher standards of transparency and liquidity, which could benefit heavily regulated coins like USDC.

Furthermore, the eventual rollout of CBDCs—digital currencies issued directly by central banks—could potentially eat into the market share of private stablecoins, especially for cross-border payments. We might see a stabilization of private stablecoins' market caps as CBDCs take over government-sanctioned financial rails.

Here are key trends to watch:

- Increased scrutiny over reserve composition and regular auditing.

- Potential adoption of stablecoins by major traditional banks (TBDs).

- A shift in focus towards multi-asset or basket-pegged stablecoins.

- Greater integration of the top stablecoins into mainstream payment systems.

Conclusion

Monitoring Stablecoins By Market Cap is more than just tracking numbers; it is about assessing trust, liquidity, and overall stability within the cryptocurrency ecosystem. Tether and USDC dominate the landscape, providing essential utility for traders and institutions, though they cater to slightly different needs regarding regulatory compliance versus pervasive adoption.

The stability of the entire crypto market relies heavily on the perceived health and transparency of these massive stablecoin market caps. As regulation evolves and new decentralized options like DAI mature, the structure of the top five stablecoins will continue to shift, but their importance as the backbone of digital finance will only grow.

Frequently Asked Questions (FAQ) About Stablecoins By Market Cap

- What does Market Cap mean for a stablecoin?

- The market capitalization of a stablecoin represents the total number of coins in circulation multiplied by its price (ideally $1). It is essentially the total dollar value held in reserve or backing that specific coin. A larger market cap indicates greater adoption and deeper liquidity.

- Is the largest stablecoin always the safest option?

- Not necessarily. While the largest stablecoins (like USDT and USDC) generally offer the best liquidity, safety depends on the quality and transparency of their reserves and their regulatory compliance. USDC is often cited as safer due to its highly regulated status and full backing by cash and short-term Treasuries.

- How often do rankings of Stablecoins By Market Cap change?

- The very top rankings (Tether and USDC) usually remain stable, but lower rankings often change frequently. Significant shifts can occur due to regulatory crackdowns, changes in collateral strategy, or the massive adoption or abandonment of a coin within a specific blockchain ecosystem (e.g., DeFi adoption or a major protocol failure).

- Why are decentralized stablecoins like DAI smaller in market cap?

- Decentralized stablecoins like DAI are typically smaller because their creation process (requiring users to lock up crypto collateral) is more complex and capital-intensive than the centralized issuance models used by USDT or USDC. They prioritize decentralization and censorship resistance over pure scale and ease of access.

Stablecoins By Market Cap

Stablecoins By Market Cap Wallpapers

Collection of stablecoins by market cap wallpapers for your desktop and mobile devices.

Spectacular Stablecoins By Market Cap View Digital Art

Immerse yourself in the stunning details of this beautiful stablecoins by market cap wallpaper, designed for a captivating visual experience.

Captivating Stablecoins By Market Cap Scene Collection

Find inspiration with this unique stablecoins by market cap illustration, crafted to provide a fresh look for your background.

Vibrant Stablecoins By Market Cap Capture Photography

Transform your screen with this vivid stablecoins by market cap artwork, a true masterpiece of digital design.

Captivating Stablecoins By Market Cap Capture Photography

A captivating stablecoins by market cap scene that brings tranquility and beauty to any device.

Gorgeous Stablecoins By Market Cap Artwork Concept

Immerse yourself in the stunning details of this beautiful stablecoins by market cap wallpaper, designed for a captivating visual experience.

Dynamic Stablecoins By Market Cap Scene for Mobile

This gorgeous stablecoins by market cap photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Mesmerizing Stablecoins By Market Cap Scene Photography

Transform your screen with this vivid stablecoins by market cap artwork, a true masterpiece of digital design.

Mesmerizing Stablecoins By Market Cap Photo Digital Art

Discover an amazing stablecoins by market cap background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Amazing Stablecoins By Market Cap View in 4K

Experience the crisp clarity of this stunning stablecoins by market cap image, available in high resolution for all your screens.

Stunning Stablecoins By Market Cap Abstract for Your Screen

Find inspiration with this unique stablecoins by market cap illustration, crafted to provide a fresh look for your background.

Crisp Stablecoins By Market Cap View for Desktop

A captivating stablecoins by market cap scene that brings tranquility and beauty to any device.

Vibrant Stablecoins By Market Cap View Photography

Discover an amazing stablecoins by market cap background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Breathtaking Stablecoins By Market Cap View in 4K

Explore this high-quality stablecoins by market cap image, perfect for enhancing your desktop or mobile wallpaper.

High-Quality Stablecoins By Market Cap Landscape Illustration

Explore this high-quality stablecoins by market cap image, perfect for enhancing your desktop or mobile wallpaper.

Detailed Stablecoins By Market Cap Scene for Desktop

Transform your screen with this vivid stablecoins by market cap artwork, a true masterpiece of digital design.

Exquisite Stablecoins By Market Cap Design Concept

This gorgeous stablecoins by market cap photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Artistic Stablecoins By Market Cap View for Mobile

Immerse yourself in the stunning details of this beautiful stablecoins by market cap wallpaper, designed for a captivating visual experience.

Crisp Stablecoins By Market Cap Scene for Mobile

Find inspiration with this unique stablecoins by market cap illustration, crafted to provide a fresh look for your background.

Beautiful Stablecoins By Market Cap Background in HD

Experience the crisp clarity of this stunning stablecoins by market cap image, available in high resolution for all your screens.

Serene Stablecoins By Market Cap Wallpaper for Mobile

Experience the crisp clarity of this stunning stablecoins by market cap image, available in high resolution for all your screens.

Download these stablecoins by market cap wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Stablecoins By Market Cap"

Post a Comment