Stable Coins Market Cap

Decoding the Digital Dollar: Understanding the Stable Coins Market Cap

Hey there! If you've spent any time exploring the world of cryptocurrency, you've definitely come across stablecoins. They are the essential bridge between the volatile, exciting crypto universe and the steady realm of traditional finance. But to truly understand their importance, we need to dive deep into a key metric: the Stable Coins Market Cap.

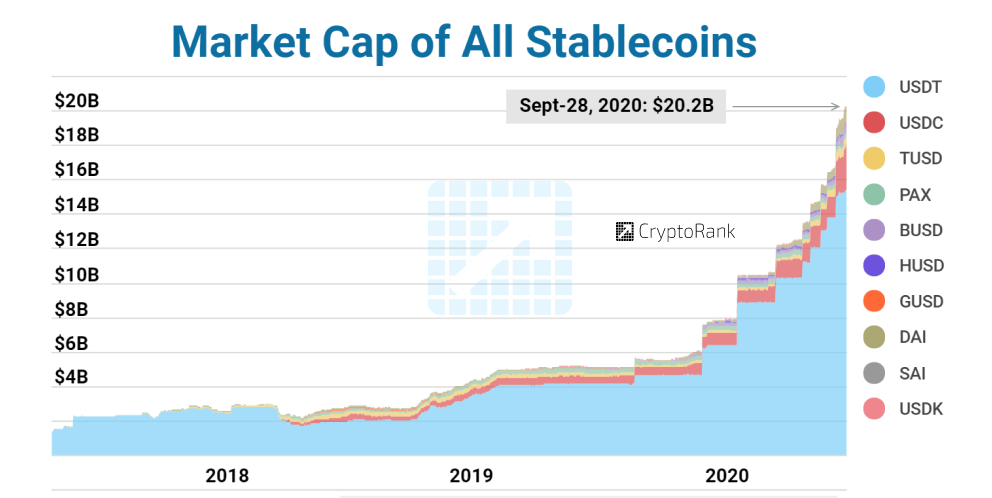

This isn't just a number; it represents the total value of all stablecoins currently in circulation. Monitoring the Stable Coins Market Cap gives us crucial insights into liquidity, market sentiment, and the overall adoption rate of digital assets by the wider financial world. Let's break down why this metric matters and what it tells us about the future of finance.

Think of stablecoins as the crypto market's oxygen. Without them, it would be much harder for traders to move quickly between highly volatile assets like Bitcoin or Ethereum and a reliable store of value without exiting the crypto ecosystem entirely.

What Exactly is the Stable Coins Market Cap?

In simple terms, market capitalization (market cap) is calculated by multiplying the current supply of a cryptocurrency by its current price. Since stablecoins are designed to maintain a value of $1, the Stable Coins Market Cap is fundamentally the total number of stablecoin units outstanding.

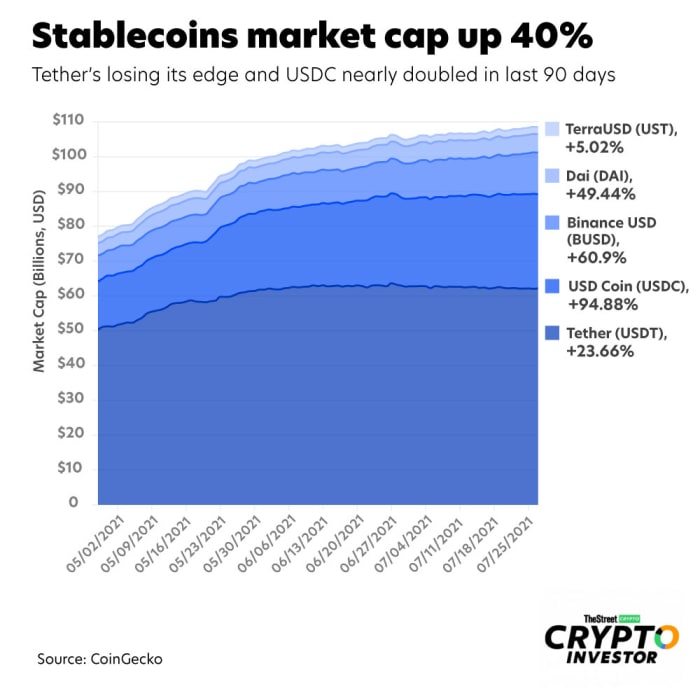

This figure provides a reliable indicator of the amount of "dry powder"—or available liquidity—that is sitting on the sidelines, ready to enter or exit volatile crypto markets. When the Stable Coins Market Cap rises, it usually means more funds are entering the ecosystem, waiting for an opportune moment to trade.

The stability provided by these assets is their greatest strength. They offer a sanctuary during times of high volatility, allowing investors to preserve their capital without converting back to fiat currency through a bank, which can often be slow and costly.

The Mechanism: How Stablecoins Maintain Their Peg

Maintaining the $1 peg is the core challenge and defining feature of a stablecoin. Their backing mechanism is what dictates the trust level and, consequently, their share of the overall Stable Coins Market Cap. Not all stablecoins are created equal, and they primarily fall into these categories:

- Fiat-Collateralized: These coins, like Tether (USDT) and USD Coin (USDC), are backed 1:1 by real-world assets such as cash, Treasury bills, or commercial paper held in reserve accounts.

- Crypto-Collateralized: These are backed by other cryptocurrencies (often over-collateralized to account for volatility). Dai (DAI) is a prime example of this model.

- Algorithmic: These coins rely on complex smart contract algorithms and arbitrage mechanisms to maintain their peg, without direct collateral backing. While innovative, some algorithmic models have proven brittle in extreme market conditions.

The reliability of the reserve assets is paramount. Transparency and regular audits are becoming increasingly important for the major players to maintain investor confidence and sustain their high Stable Coins Market Cap figures.

Why the Stable Coins Market Cap is Crucial for the Crypto Ecosystem

The total value of stablecoins reflects far more than just circulating supply. It directly influences market stability, trading efficiency, and the viability of decentralized finance (DeFi) applications. A large and growing Stable Coins Market Cap signals a robust and maturing ecosystem.

Here's why this metric is so important:

- Liquidity Provider: Stablecoins are the primary medium for trading pairs on nearly every major crypto exchange. They enable efficient trading and high volume, which keeps transaction costs competitive.

- DeFi Backbone: The entire DeFi lending and borrowing structure is fundamentally reliant on stablecoins. They provide the necessary capital for yield farming, collateralized loans, and decentralized exchanges.

- Global Remittance: For users in regions with high inflation or strict capital controls, stablecoins offer a fast, cheap, and reliable mechanism for cross-border transfers and savings, bypassing traditional banking bottlenecks.

- Investor Sentiment: A sudden contraction in the Stable Coins Market Cap often indicates that large institutional players or whales are withdrawing capital from the crypto space and converting it back into traditional fiat currencies.

It acts as a reliable gauge of professional interest. When the total stablecoin supply expands, it generally suggests that serious money is flowing into crypto markets, anticipating future growth opportunities.

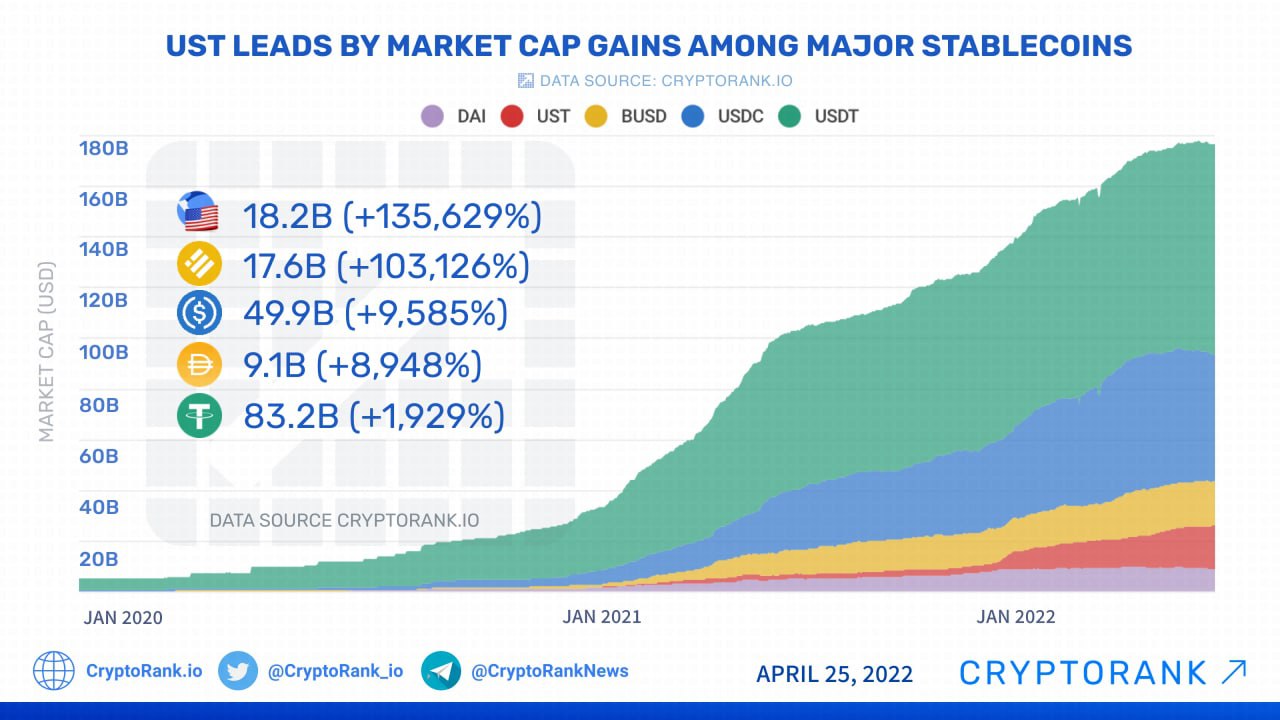

The Giants: Key Stablecoins Dominating the Market Cap

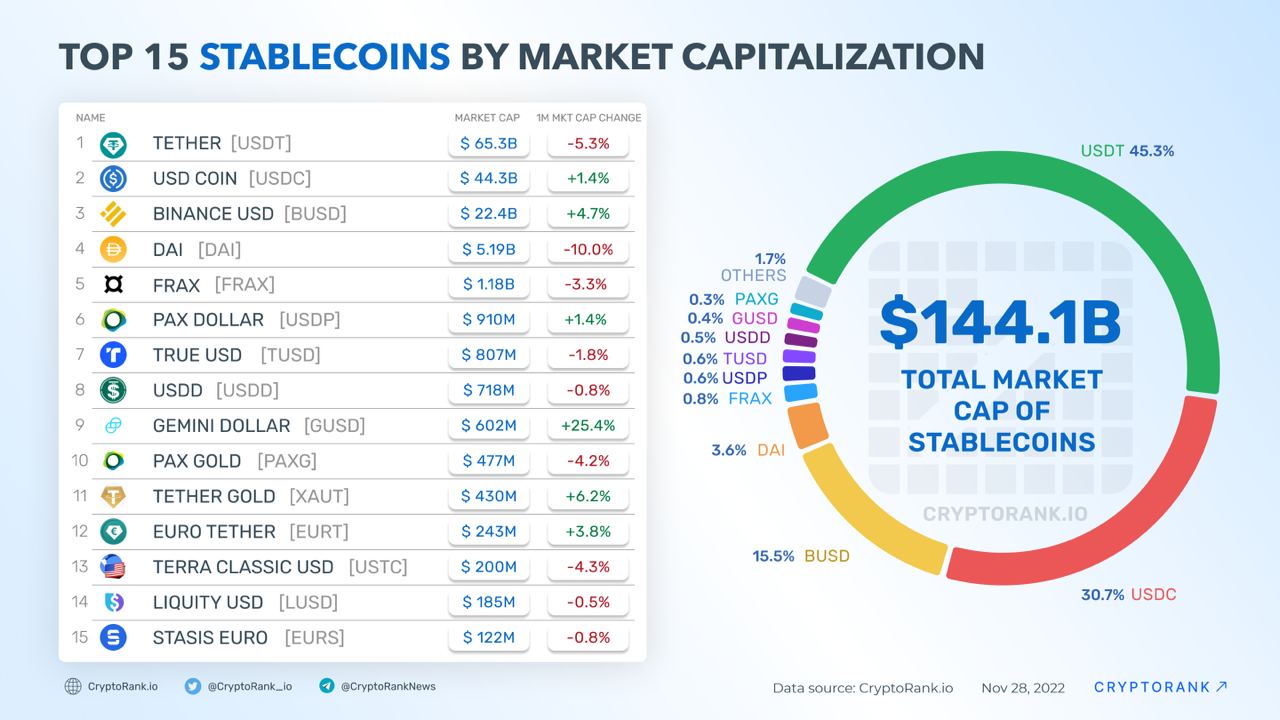

The majority of the Stable Coins Market Cap is controlled by just a few key players. Understanding these market giants is essential because their decisions and regulatory status directly impact the stability of the entire crypto world.

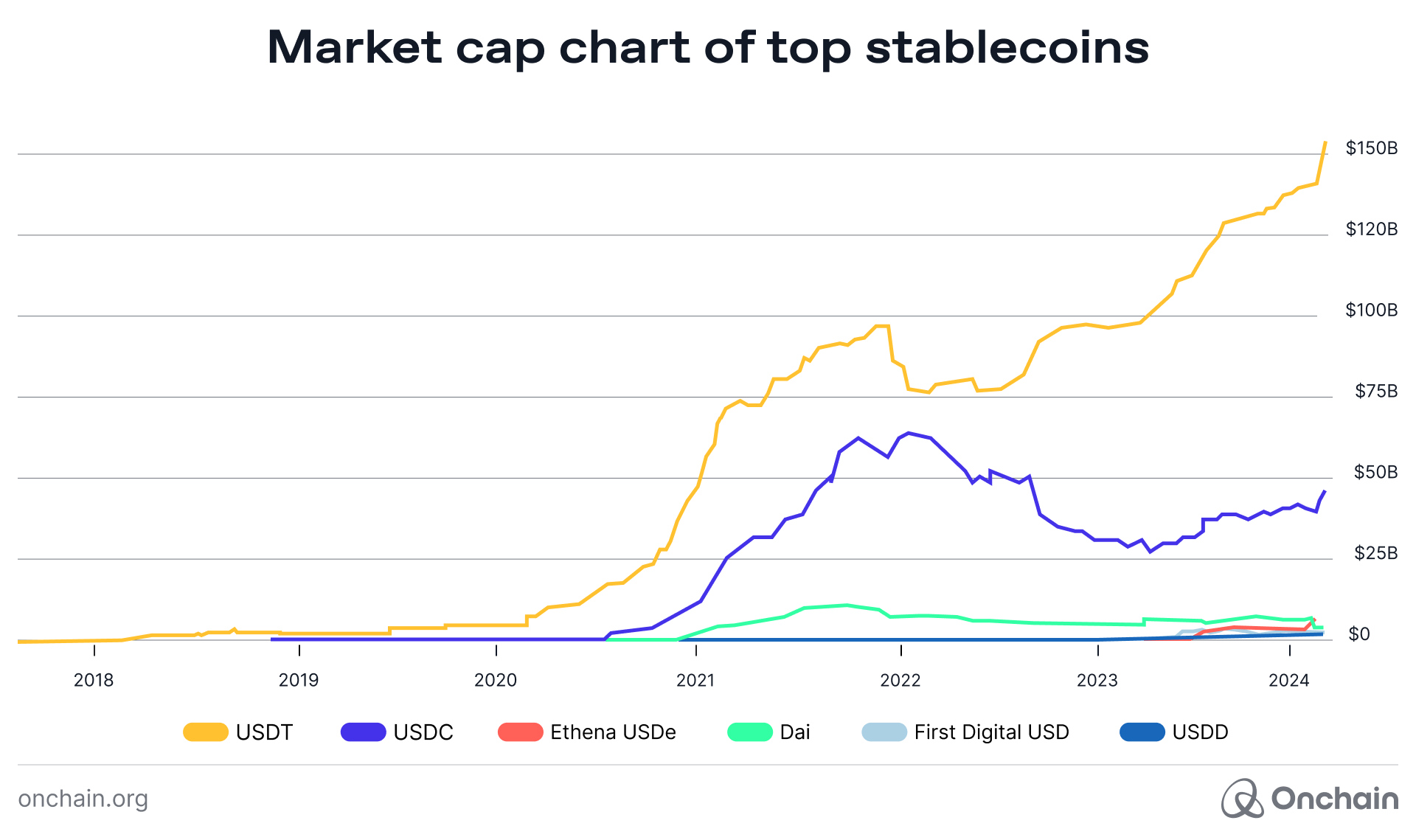

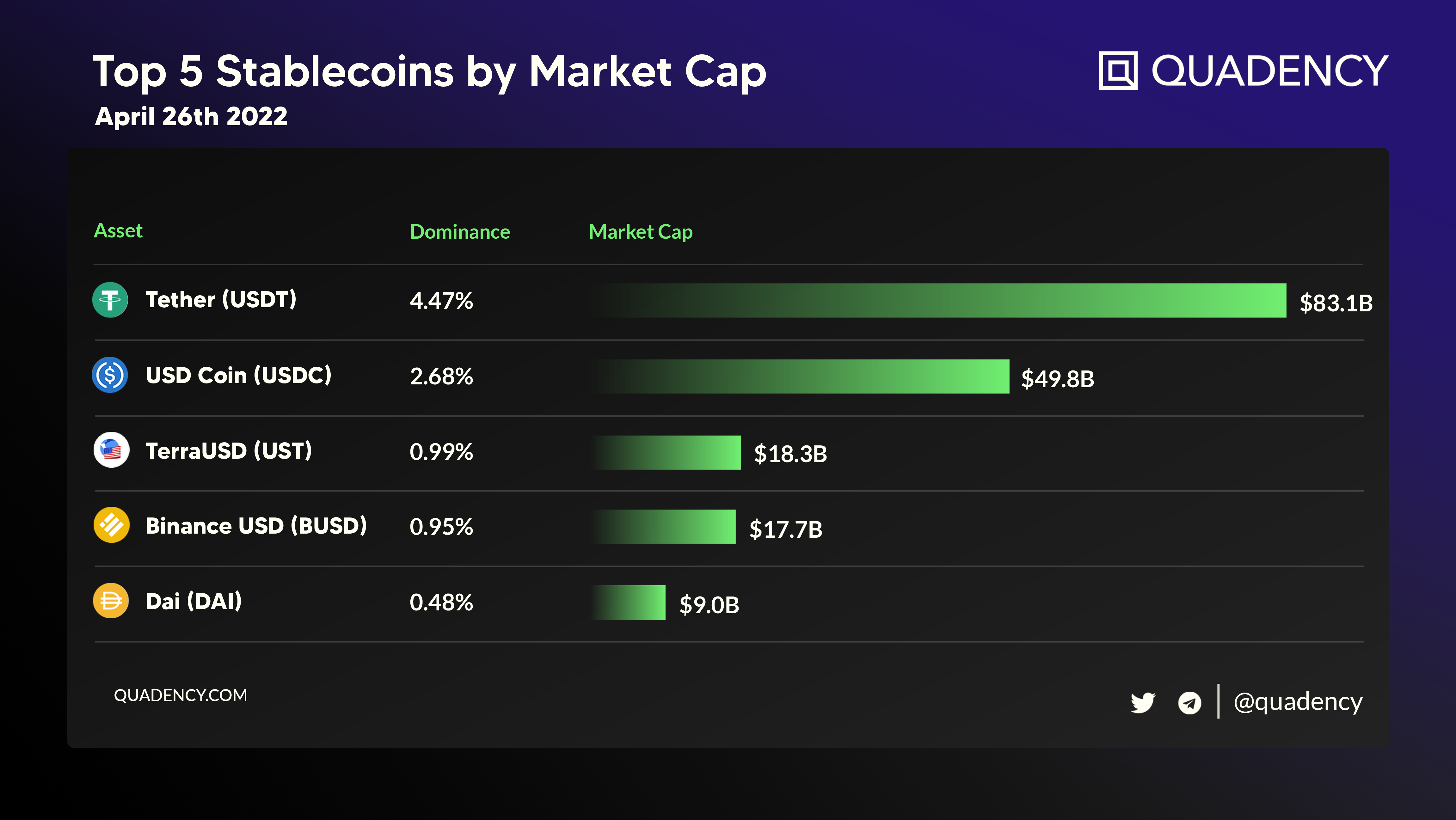

Tether (USDT) and USD Coin (USDC) are the undisputed leaders. While USDT has historically dominated in terms of raw supply, USDC has gained significant ground, often favored by institutional investors due to its increased regulatory compliance and transparency efforts.

The battle for dominance impacts trading pairs and liquidity across various decentralized and centralized exchanges. When one major stablecoin faces scrutiny or uncertainty, traders often flock to the competitor, causing a rapid shift in market cap distribution.

Monitoring Market Dominance and Velocity

Beyond the total supply, it's also important to look at the velocity of stablecoins. Velocity measures how often these coins change hands or move across the blockchain. High velocity suggests active market participation and heavy use in DeFi protocols.

The dominance metric tells us what percentage of the total Stable Coins Market Cap each coin holds. If Tether's dominance starts to slip and USDC's rises, this shows a potential shift in where the smart money is placing its trust, often driven by external factors like regulation or audit transparency.

Furthermore, the flow of stablecoins onto exchange platforms versus their withdrawal is a leading indicator for potential market movements. When stablecoins flood exchanges, traders are preparing for a buying spree, suggesting bullish sentiment.

Factors Driving and Constraining Stable Coins Market Cap Growth

The growth trajectory of the total Stable Coins Market Cap isn't linear; it responds to global macroeconomic trends, regulatory clarity, and technological advancements. Several key factors are currently influencing its trajectory:

- Regulatory Clarity: The biggest factor is government oversight. Clear rules on how stablecoin issuers must manage their reserves and conduct audits provide much-needed confidence, attracting massive institutional capital. Uncertainty, however, acts as a severe dampener.

- Interest Rate Environment: When central banks raise interest rates, it becomes more expensive for stablecoin issuers to hold underlying assets (like Treasury bills), potentially increasing their profitability. This can incentivize expansion and attract more traditional finance players.

- DeFi Adoption: The continued innovation and expansion of decentralized applications—especially sophisticated lending platforms and decentralized autonomous organizations (DAOs)—creates persistent demand for stable assets.

- Competition from CBDCs: Central Bank Digital Currencies (CBDCs), if widely adopted, could potentially compete with private stablecoins. However, many experts believe CBDCs will coexist, fulfilling different needs in the digital economy.

The sheer size of the current Stable Coins Market Cap makes it impossible for regulators to ignore, meaning future growth will heavily depend on successful integration into established financial compliance frameworks worldwide.

Conclusion: The Stable Coins Market Cap as a Global Barometer

The Stable Coins Market Cap is far more than an academic metric; it is a real-time barometer of the health and liquidity of the entire crypto market. It reflects investor trust, regulatory certainty, and the institutional adoption rate of digital assets. As the sector matures, we expect continued growth, but the market share battle between competing coins will intensify, demanding greater transparency from all issuers.

By keeping an eye on the total stablecoin supply, you are essentially tracking the flow of capital ready to interact with decentralized technologies. Whether you are a casual investor or a dedicated DeFi enthusiast, understanding this critical metric is essential for navigating the complex digital economy.

Frequently Asked Questions (FAQ) About the Stable Coins Market Cap

- What is the difference between Stable Coins Market Cap and total Crypto Market Cap?

- The total Crypto Market Cap includes the value of all cryptocurrencies, including highly volatile assets like Bitcoin and Ethereum. The Stable Coins Market Cap is a subset of this total, measuring only the value of coins pegged to a fiat currency (usually USD).

- Why does the Stable Coins Market Cap fluctuate if the price is always $1?

- The market cap fluctuates based on the circulating supply, not the price. Issuers "mint" new stablecoins when demand increases (meaning new money is entering the crypto system) and "burn" them when demand decreases (meaning money is being redeemed for fiat).

- Which stablecoin currently holds the largest share of the Stable Coins Market Cap?

- While the dominance shifts, Tether (USDT) has historically held the largest share. However, USD Coin (USDC) remains a very strong contender, often preferred for institutional and compliance-focused operations.

- How does regulation affect the Stable Coins Market Cap?

- Regulation provides stability. When governments clarify rules around reserve requirements and issuance, it reduces risk, encouraging institutional capital to enter the space, thereby increasing the total Stable Coins Market Cap.

Stable Coins Market Cap

Stable Coins Market Cap Wallpapers

Collection of stable coins market cap wallpapers for your desktop and mobile devices.

Vibrant Stable Coins Market Cap Capture Photography

Transform your screen with this vivid stable coins market cap artwork, a true masterpiece of digital design.

Spectacular Stable Coins Market Cap View Digital Art

Immerse yourself in the stunning details of this beautiful stable coins market cap wallpaper, designed for a captivating visual experience.

Spectacular Stable Coins Market Cap Landscape Concept

This gorgeous stable coins market cap photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Beautiful Stable Coins Market Cap Design Digital Art

Experience the crisp clarity of this stunning stable coins market cap image, available in high resolution for all your screens.

Dynamic Stable Coins Market Cap Scene for Mobile

This gorgeous stable coins market cap photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Mesmerizing Stable Coins Market Cap Scene Photography

Transform your screen with this vivid stable coins market cap artwork, a true masterpiece of digital design.

Mesmerizing Stable Coins Market Cap Photo Digital Art

Discover an amazing stable coins market cap background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp Stable Coins Market Cap View for Desktop

A captivating stable coins market cap scene that brings tranquility and beauty to any device.

High-Quality Stable Coins Market Cap Landscape Illustration

Explore this high-quality stable coins market cap image, perfect for enhancing your desktop or mobile wallpaper.

Mesmerizing Stable Coins Market Cap Photo for Your Screen

Experience the crisp clarity of this stunning stable coins market cap image, available in high resolution for all your screens.

Vivid Stable Coins Market Cap Artwork Concept

Discover an amazing stable coins market cap background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Artistic Stable Coins Market Cap Image Photography

Immerse yourself in the stunning details of this beautiful stable coins market cap wallpaper, designed for a captivating visual experience.

Artistic Stable Coins Market Cap View for Mobile

Immerse yourself in the stunning details of this beautiful stable coins market cap wallpaper, designed for a captivating visual experience.

Exquisite Stable Coins Market Cap Image for Mobile

Find inspiration with this unique stable coins market cap illustration, crafted to provide a fresh look for your background.

Breathtaking Stable Coins Market Cap Photo for Your Screen

Explore this high-quality stable coins market cap image, perfect for enhancing your desktop or mobile wallpaper.

Detailed Stable Coins Market Cap Scene for Desktop

Transform your screen with this vivid stable coins market cap artwork, a true masterpiece of digital design.

High-Quality Stable Coins Market Cap Design Digital Art

Discover an amazing stable coins market cap background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp Stable Coins Market Cap Capture Illustration

This gorgeous stable coins market cap photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Lush Stable Coins Market Cap Abstract in 4K

Find inspiration with this unique stable coins market cap illustration, crafted to provide a fresh look for your background.

Vivid Stable Coins Market Cap Artwork Digital Art

Discover an amazing stable coins market cap background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Download these stable coins market cap wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Stable Coins Market Cap"

Post a Comment