Stable Coins By Market Cap

Stable Coins By Market Cap: Your Ultimate Guide to Stability in Crypto

Welcome to the world of stablecoins! If you've been dabbling in cryptocurrency, you know how volatile things can get. One minute Bitcoin is soaring, the next it's taking a dive. That's where stablecoins step in, offering a much-needed anchor in the stormy crypto seas.

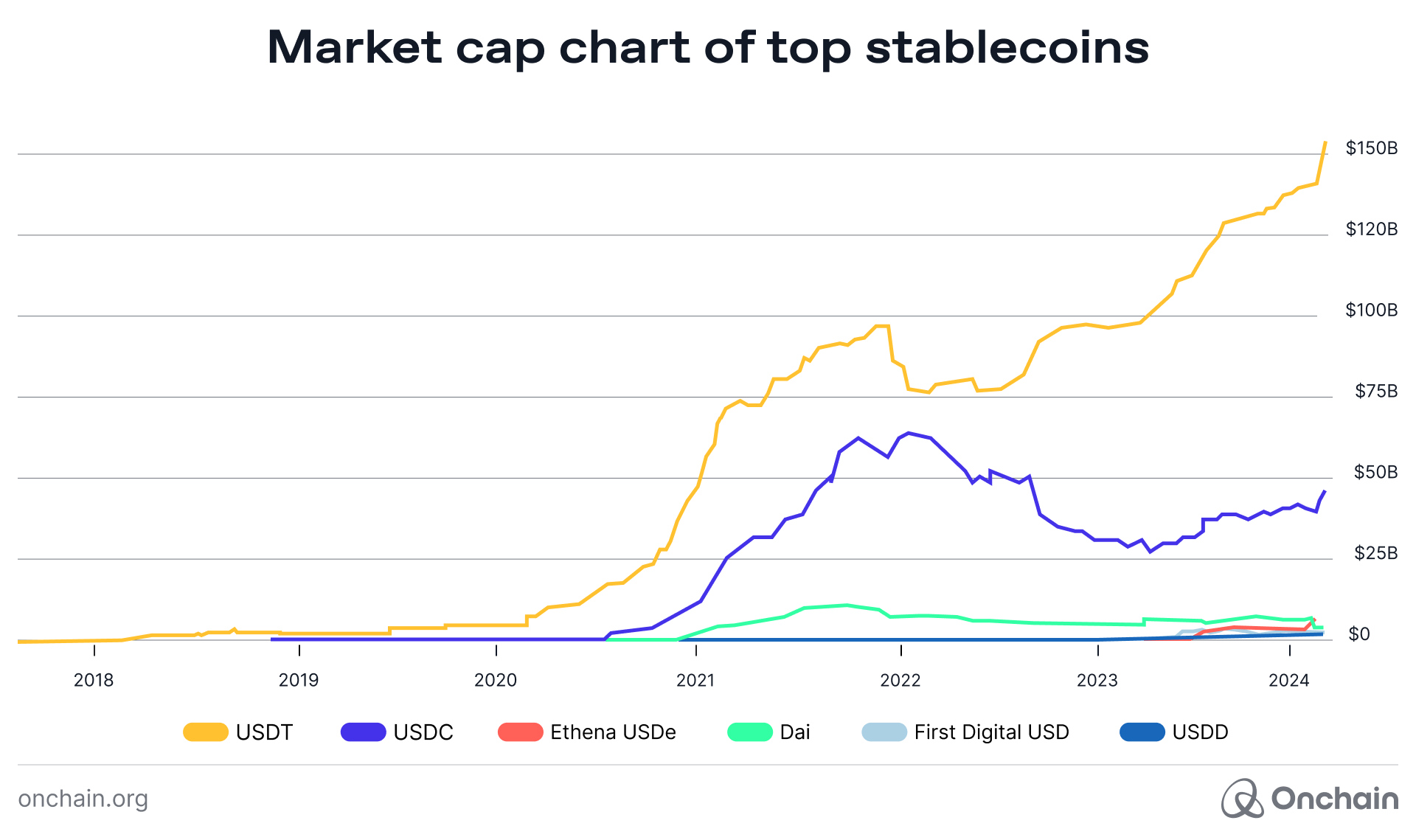

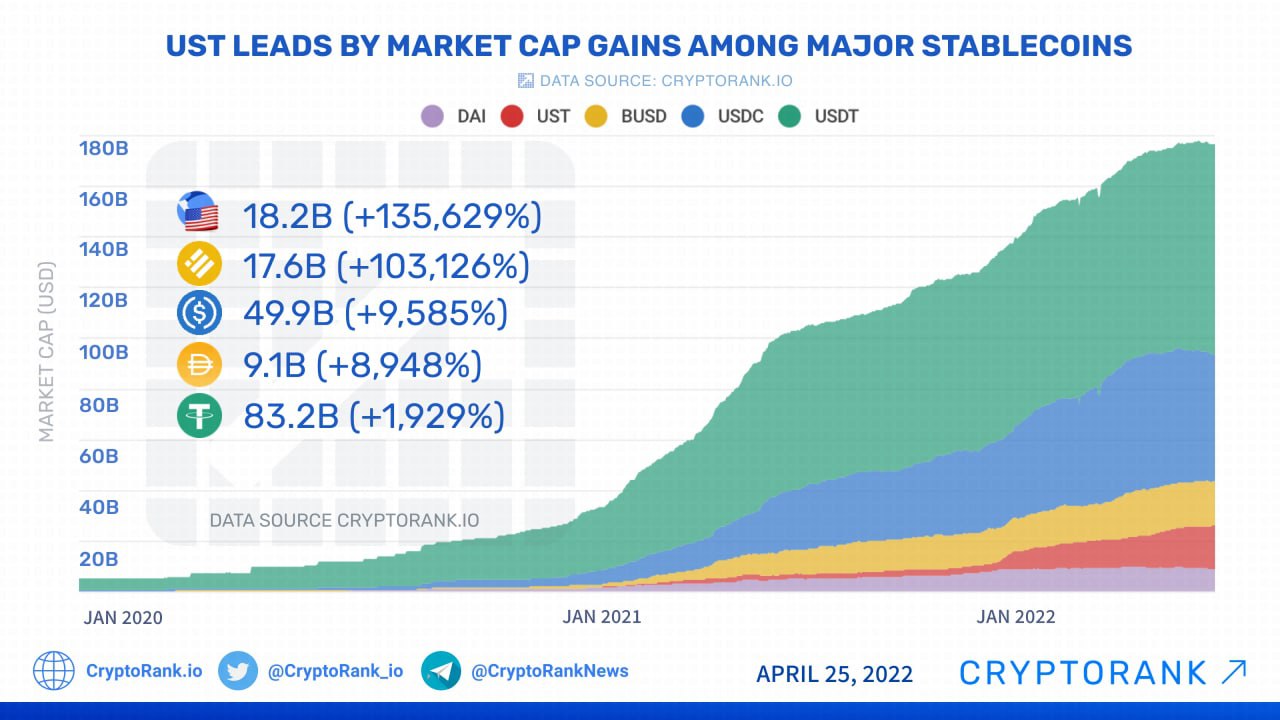

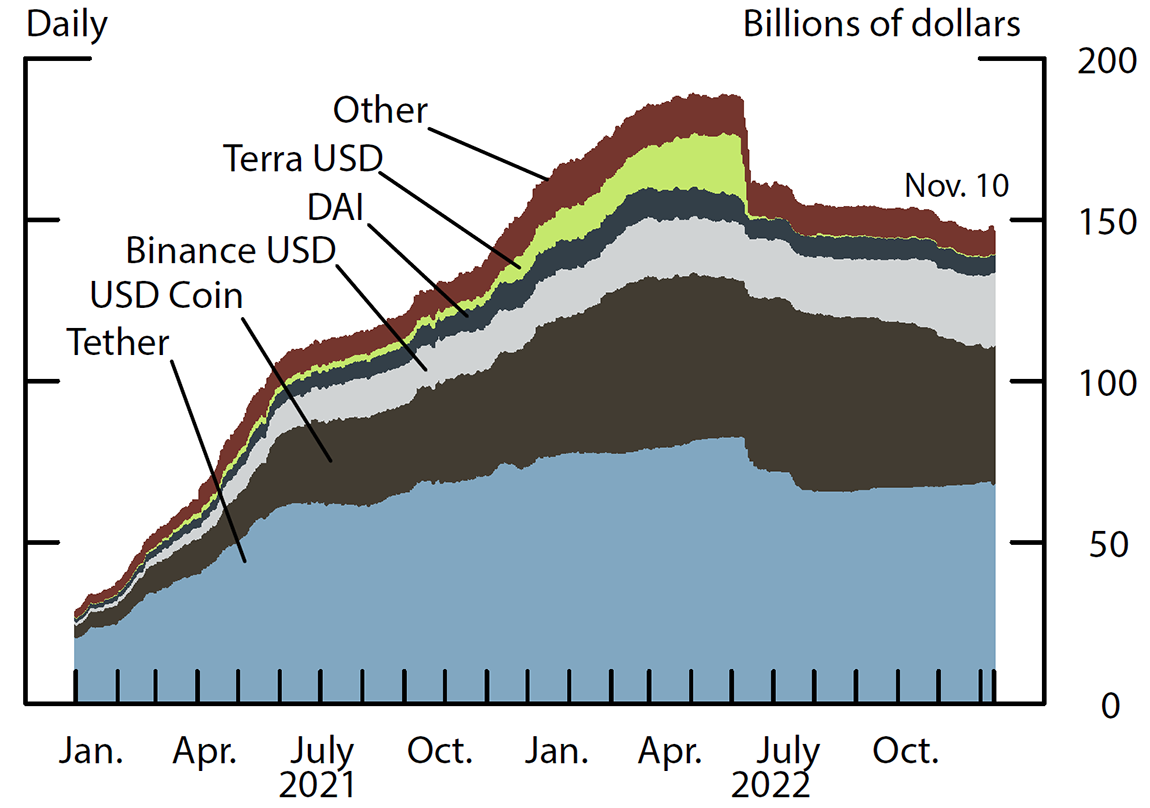

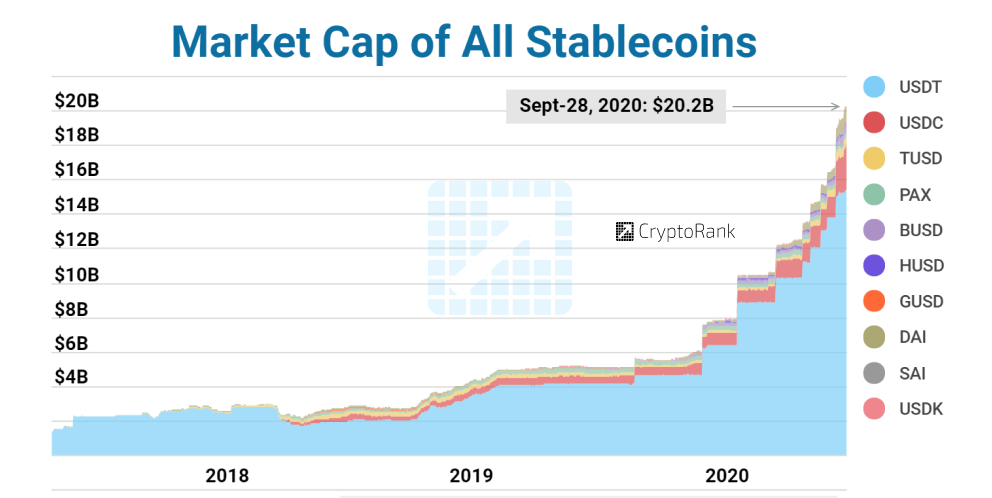

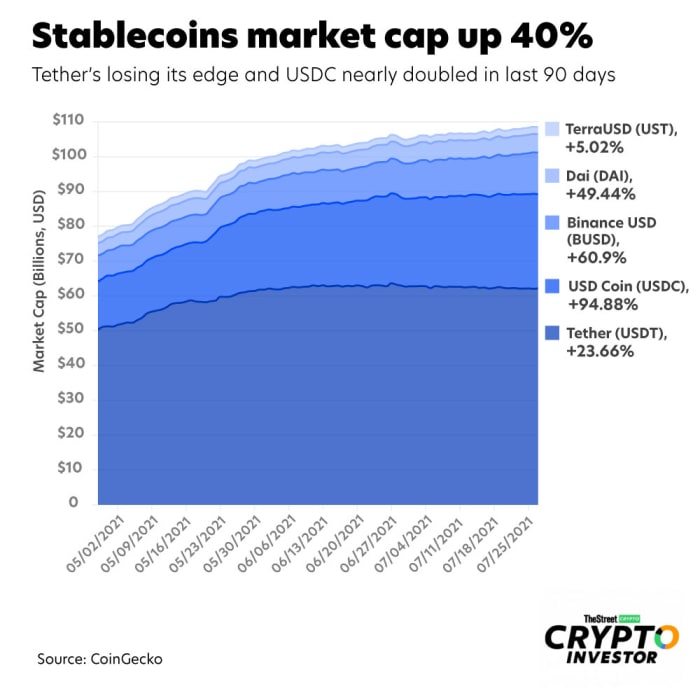

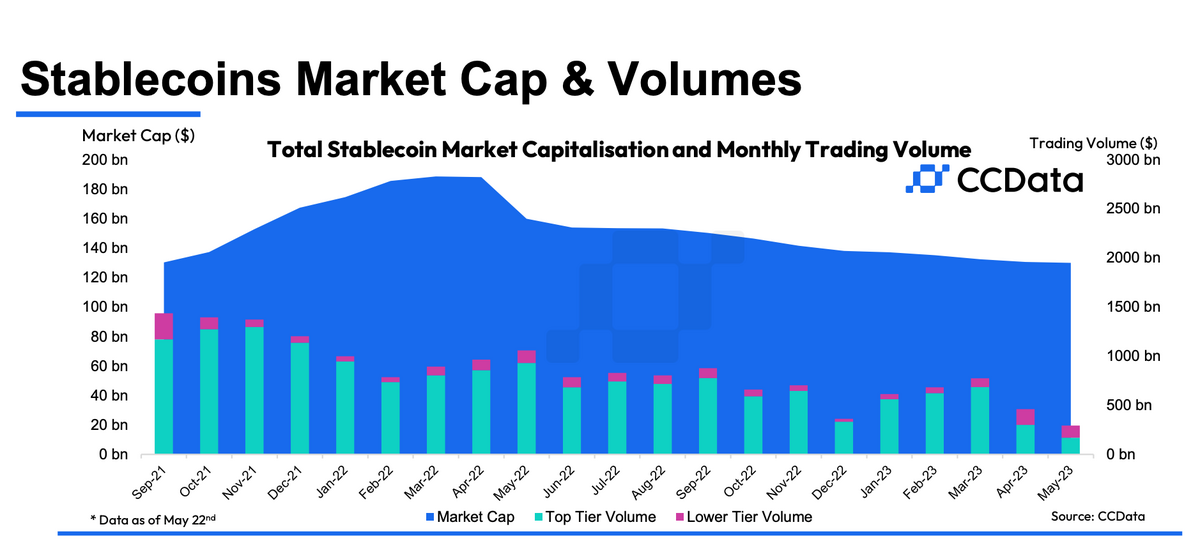

Understanding the landscape of Stable Coins By Market Cap is essential for anyone looking to mitigate risk, manage liquidity, or simply understand the infrastructure holding the decentralized finance (DeFi) world together. We are going to break down who the major players are, why market cap matters, and how these digital assets keep their promise of stability.

What Exactly Are Stablecoins and Why Do They Matter?

Simply put, stablecoins are cryptocurrencies designed to maintain a stable value relative to a specific asset, usually a fiat currency like the U.S. Dollar (USD). Their primary goal is to combine the best features of cryptocurrencies—decentralization, transparency, and speed—with the reliability of traditional currencies.

Think of them as digital dollars you can use on the blockchain. Because they rarely fluctuate, they are perfect for trading, lending, and quick transfers without worrying about the price crashing between transactions. They act as the go-to currency for crypto traders looking to "cash out" quickly without leaving the crypto ecosystem altogether.

Their importance is huge because they provide liquidity. Without stablecoins, moving large amounts of value would involve continuous conversions back to fiat, introducing unnecessary delays and fees. Stablecoins make the entire DeFi economy flow smoothly.

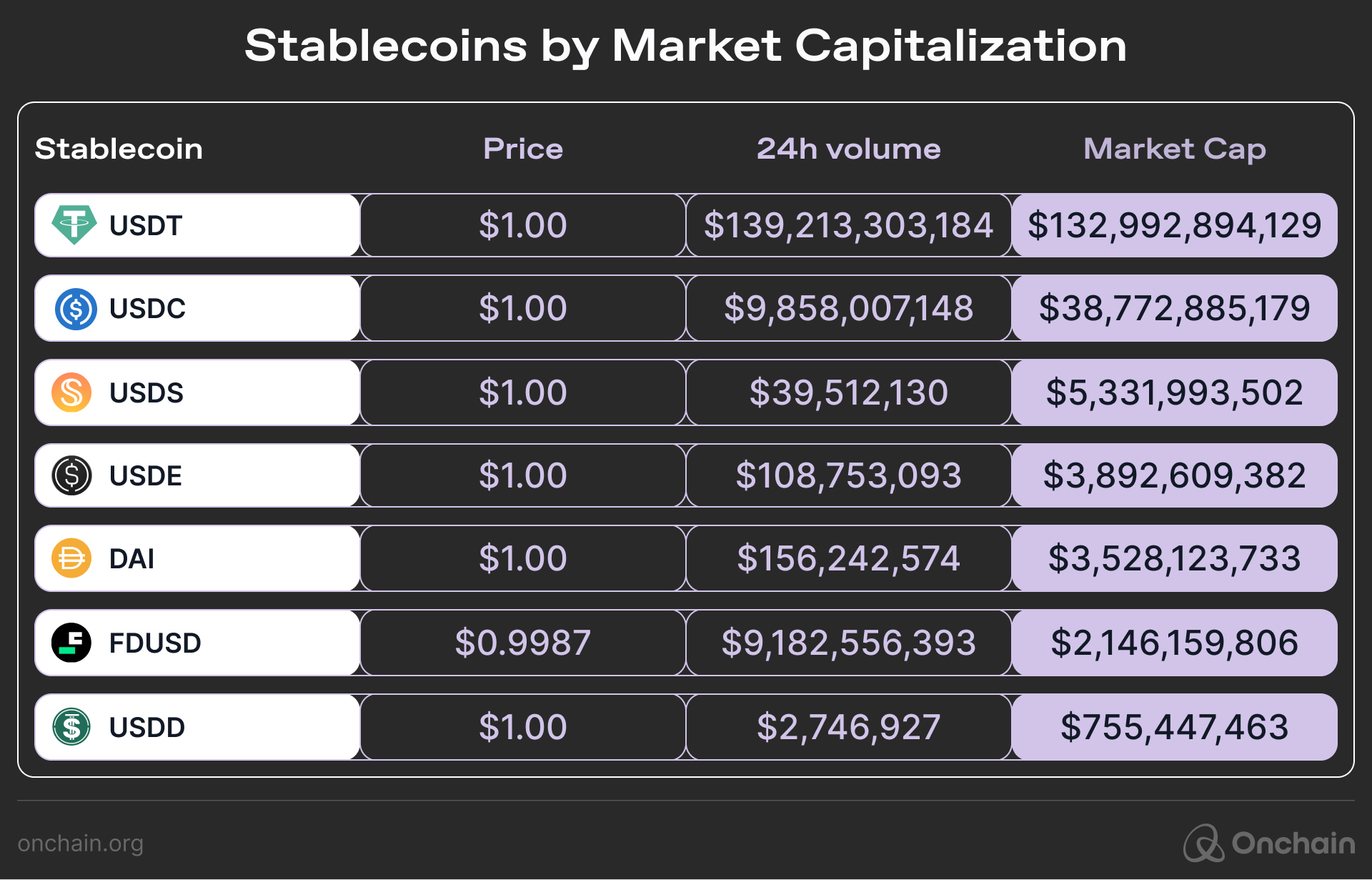

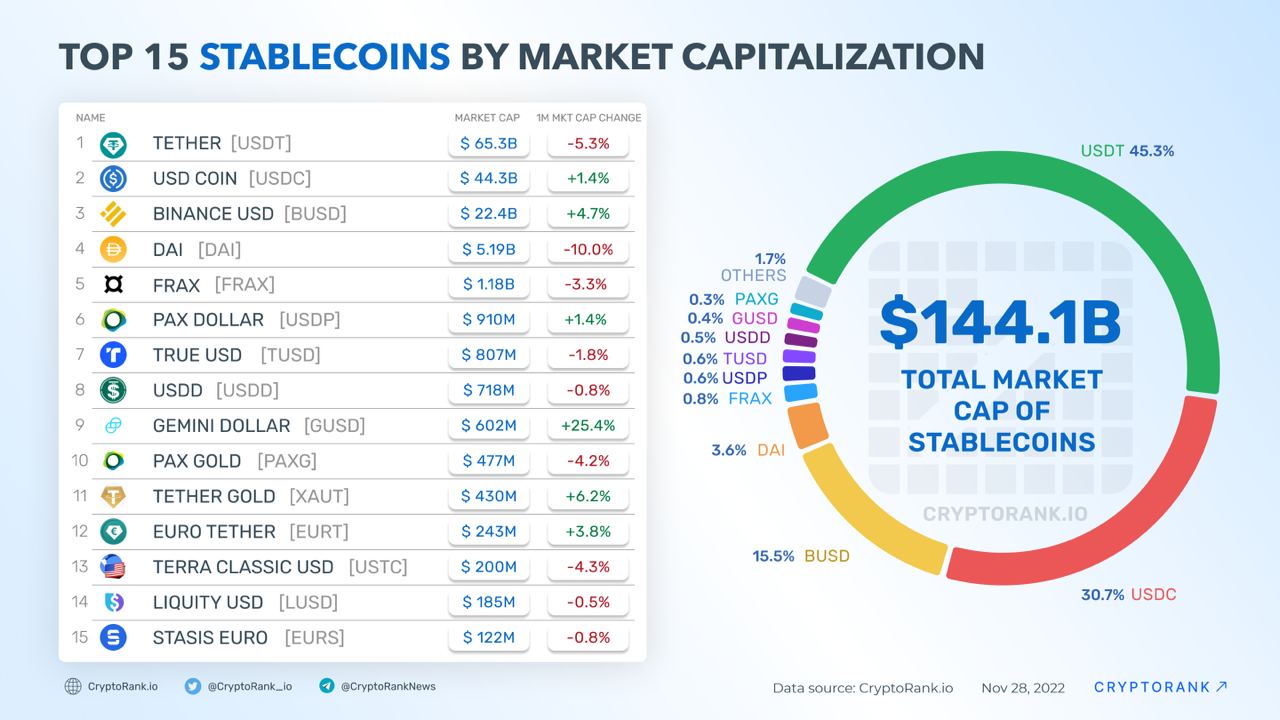

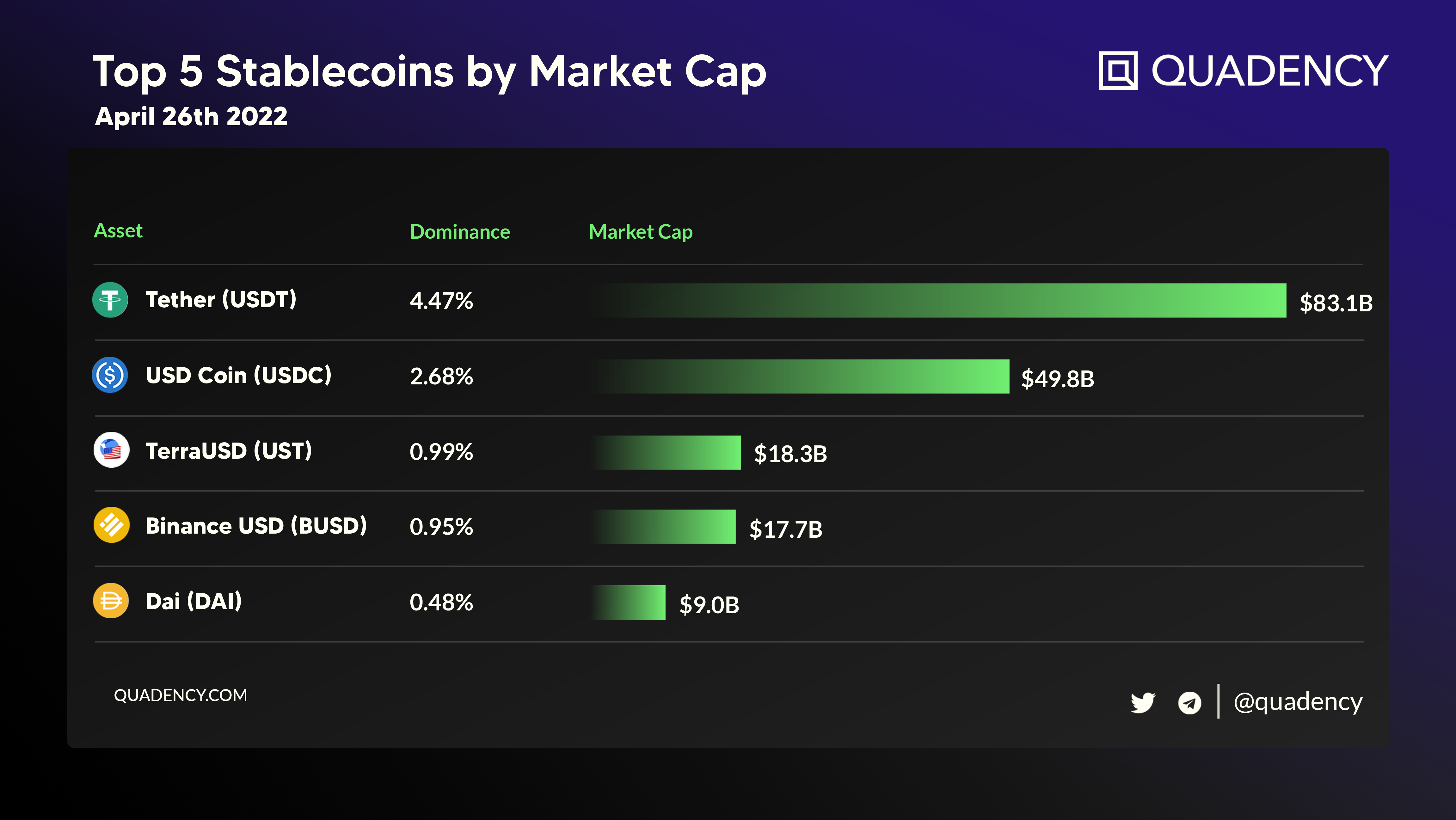

The Big Players: Top Stable Coins By Market Cap

When you analyze the list of Stable Coins By Market Cap, you are essentially looking at which stable assets are holding the most value in reserve. This market cap is calculated the same way as any other crypto: current price multiplied by the circulating supply. For stablecoins, since the price is almost always $1.00, the market cap directly reflects the total amount of reserves backing that coin.

Here are the undisputed leaders that dominate this critical sector:

USDT (Tether): The Giant of the Stablecoin World

Tether (USDT) consistently ranks as the largest stablecoin by market capitalization, often sitting among the top five cryptocurrencies overall. Launched back in 2014, USDT has cemented itself as the primary vehicle for high-volume trading across centralized exchanges globally.

While USDT has faced scrutiny regarding the composition and transparency of its reserves, its first-mover advantage and integration into numerous blockchain ecosystems keep its market dominance robust. Many traders prefer USDT due to its unparalleled liquidity.

USDC (USD Coin): The Regulated Challenger

USD Coin (USDC) is the main rival to Tether and is managed by Circle and Coinbase through the Centre consortium. USDC prides itself on its transparency and regulatory compliance. Every USDC token in circulation is reportedly backed by one dollar held in regulated U.S. financial institutions.

Many institutional investors and DeFi protocols favor USDC due to its regularly audited and clearly defined reserve holdings. Its growth rate has been spectacular, constantly challenging Tether for the top spot in the stablecoin rankings. If you prioritize trust and regulatory oversight, USDC is often the choice.

DAI: The Decentralized Dark Horse

Unlike USDT and USDC, which are backed by fiat held in banks, Dai is a crypto-collateralized stablecoin. It's managed entirely by the MakerDAO protocol and its price stability is maintained through smart contracts and collateralized debt positions (CDPs).

DAI offers true decentralized stability, meaning no single central authority controls its issuance or backing. While its market cap is significantly smaller than the fiat-backed giants, it remains critically important for the DeFi sector seeking to avoid centralized risks.

Understanding Market Capitalization for Stablecoins

In the volatile world of traditional cryptocurrencies, market capitalization often reflects investor confidence and speculative value. However, for stablecoins, the metric tells a slightly different, yet equally important story.

When we look at Stable Coins By Market Cap, we are primarily measuring adoption and utility. A higher market cap indicates:

- Increased demand from traders needing liquidity.

- A larger footprint across various blockchains and DeFi platforms.

- Greater integration with existing financial systems.

Furthermore, rapid changes in a stablecoin's market cap can signal significant shifts in crypto market sentiment. For instance, a sudden drop in a stablecoin's market cap might suggest a large redemption event or a shift in capital to a rival stablecoin.

Different Types of Stablecoins and Their Backing

Not all stablecoins are created equal, and understanding their backing mechanism is vital to assessing their risk profile and trustworthiness. The method of collateralization determines how resilient a stablecoin is during market stress.

Fiat-Collateralized vs. Crypto-Collateralized

Most of the leading stablecoins fall into one of these two main categories. Fiat-collateralized coins, like USDT and USDC, promise a 1:1 backing with fiat currency or equivalent short-term assets held in bank accounts. The trust here relies heavily on the issuing entity.

Crypto-collateralized stablecoins, like DAI, are backed by other cryptocurrencies held in smart contracts. Because the underlying crypto collateral is volatile, these systems are often overcollateralized—meaning more than $1 worth of crypto is locked up for every $1 of stablecoin issued—to cushion against rapid price drops.

Algorithmic Stablecoins (A Word of Caution)

Algorithmic stablecoins attempt to maintain their peg through automated mechanisms involving supply and demand adjustments, often without significant external collateral. While they promise extreme decentralization, they have proven exceptionally fragile during severe market crashes.

You may recall notable failures where algorithmic stablecoins completely lost their peg, causing significant investor losses. These models represent the riskiest end of the stablecoin spectrum and should be approached with extreme caution, especially by newcomers.

Why You Should Track Stable Coins By Market Cap

Tracking Stable Coins By Market Cap isn't just about knowing who's on top; it's a critical gauge of the entire crypto ecosystem's health and future direction. Here are a few reasons why you should keep an eye on these numbers:

- Systemic Risk Assessment: The largest stablecoins are systemically important. If a major stablecoin like USDT or USDC were to fail, the entire crypto market would face a liquidity crisis. Monitoring their market cap and reserve disclosures is crucial.

- Liquidity Indicator: High market cap means high liquidity. If you are a large trader, you need to use a stablecoin that can handle huge inflows and outflows without issues, which usually points to the market leaders.

- Regulatory Outlook: The largest stablecoins attract the most regulatory attention. Changes in their market cap can sometimes be precursors to new regulatory hurdles or approvals that affect all users.

The total value locked (TVL) in stablecoins is a huge indicator of capital waiting on the sidelines. When the total stablecoin market cap grows, it often means more capital is available to enter riskier assets like Bitcoin or Ethereum, signaling potential uptrends.

Conclusion

Stablecoins are the backbone of modern crypto finance, providing the necessary stability and liquidity for DeFi and trading activities. When analyzing the current crypto landscape, paying close attention to Stable Coins By Market Cap offers direct insight into the market's capital reserves and operational preferences.

While Tether (USDT) maintains its dominance, USD Coin (USDC) continues to gain favor due to its regulatory clarity and transparent audits. For those prioritizing decentralization, DAI remains the top choice. No matter your strategy, understanding the nuances of collateralization and tracking these market cap trends is essential for making informed decisions in the fast-paced crypto world.

Frequently Asked Questions (FAQ) About Stable Coins By Market Cap

- What determines the market cap of a stablecoin?

- Since stablecoins are designed to maintain a $1 price peg, their market capitalization is essentially determined by the total number of stablecoins currently in circulation. If a stablecoin has 50 billion tokens issued, its market cap is $50 billion.

- Is a higher stablecoin market cap always better?

- Generally, yes. A higher market cap indicates higher adoption, greater liquidity, and usually, stronger confidence from institutional and retail users. However, it also means the coin is systemically more important, increasing the potential impact of any failure.

- Why did USDC market cap grow so quickly compared to USDT?

- USDC's rapid growth is largely attributed to its transparent reserve reporting and compliance efforts. Many corporate entities and institutional investors prefer USDC because its reserves are frequently audited and clearly held in traditional, regulated assets, offering greater assurance than USDT historically provided.

- How does market cap affect stablecoin stability?

- Market cap itself doesn't directly affect stability (the peg mechanisms do that), but a very large market cap means the stablecoin is more resilient against small redemption events. Massive liquidity allows the system to absorb large outflows without immediate destabilization.

- Where can I track the live rankings of Stable Coins By Market Cap?

- You can track the live market capitalization and rankings of stablecoins on popular crypto data websites such as CoinMarketCap or CoinGecko. These sites provide real-time data on the circulating supply and total capitalization for all major stable assets.

Stable Coins By Market Cap

Stable Coins By Market Cap Wallpapers

Collection of stable coins by market cap wallpapers for your desktop and mobile devices.

Vibrant Stable Coins By Market Cap Capture Photography

Transform your screen with this vivid stable coins by market cap artwork, a true masterpiece of digital design.

Dynamic Stable Coins By Market Cap Scene for Mobile

This gorgeous stable coins by market cap photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Artistic Stable Coins By Market Cap View for Mobile

Immerse yourself in the stunning details of this beautiful stable coins by market cap wallpaper, designed for a captivating visual experience.

Captivating Stable Coins By Market Cap Capture Photography

A captivating stable coins by market cap scene that brings tranquility and beauty to any device.

Mesmerizing Stable Coins By Market Cap Scene Photography

Transform your screen with this vivid stable coins by market cap artwork, a true masterpiece of digital design.

Exquisite Stable Coins By Market Cap Design Concept

This gorgeous stable coins by market cap photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Spectacular Stable Coins By Market Cap View Digital Art

Immerse yourself in the stunning details of this beautiful stable coins by market cap wallpaper, designed for a captivating visual experience.

Beautiful Stable Coins By Market Cap Design Digital Art

Experience the crisp clarity of this stunning stable coins by market cap image, available in high resolution for all your screens.

Crisp Stable Coins By Market Cap View for Desktop

A captivating stable coins by market cap scene that brings tranquility and beauty to any device.

Mesmerizing Stable Coins By Market Cap Photo Digital Art

Discover an amazing stable coins by market cap background image, ideal for personalizing your devices with vibrant colors and intricate designs.

High-Quality Stable Coins By Market Cap Landscape Illustration

Explore this high-quality stable coins by market cap image, perfect for enhancing your desktop or mobile wallpaper.

Spectacular Stable Coins By Market Cap Landscape Concept

This gorgeous stable coins by market cap photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Breathtaking Stable Coins By Market Cap Photo for Your Screen

Explore this high-quality stable coins by market cap image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking Stable Coins By Market Cap View in 4K

Explore this high-quality stable coins by market cap image, perfect for enhancing your desktop or mobile wallpaper.

Artistic Stable Coins By Market Cap Image Photography

Immerse yourself in the stunning details of this beautiful stable coins by market cap wallpaper, designed for a captivating visual experience.

Vivid Stable Coins By Market Cap Abstract Illustration

Transform your screen with this vivid stable coins by market cap artwork, a true masterpiece of digital design.

Dynamic Stable Coins By Market Cap Design Nature

A captivating stable coins by market cap scene that brings tranquility and beauty to any device.

Detailed Stable Coins By Market Cap Scene for Desktop

Transform your screen with this vivid stable coins by market cap artwork, a true masterpiece of digital design.

Vibrant Stable Coins By Market Cap Picture in HD

Explore this high-quality stable coins by market cap image, perfect for enhancing your desktop or mobile wallpaper.

Spectacular Stable Coins By Market Cap Wallpaper for Mobile

A captivating stable coins by market cap scene that brings tranquility and beauty to any device.

Download these stable coins by market cap wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Stable Coins By Market Cap"

Post a Comment