Top Low Market Cap Crypto

Top Low Market Cap Crypto: Unlocking Hidden Gems for Exponential Growth

Are you hunting for that elusive 100x return in the crypto world? If so, you've likely been eyeing the volatile, yet exciting, world of low market capitalization cryptocurrencies. Finding the Top Low Market Cap Crypto projects can feel like searching for a needle in a massive haystack, but the potential rewards are astronomical compared to established large-cap coins like Bitcoin or Ethereum.

This space is incredibly dynamic, offering significant upside for early adopters. However, it's vital to understand that where there is massive potential return, there is equally massive risk. We're here to guide you through navigating this environment, showing you what metrics truly matter, and how to spot potential hidden gems before they explode.

Why Low Market Cap Cryptos Matter for Portfolio Diversification

In simple terms, a Low Market Cap Crypto refers to a digital asset with a total valuation, usually below $50 million (though this definition can vary greatly depending on market conditions). These projects are often new, highly innovative, or flying under the radar.

The primary reason investors flock to these smaller projects is the scalability factor. A $100 billion coin needs $100 billion more capital to double its value. Conversely, a $10 million coin only needs $10 million more capital inflow to achieve the same 100% gain. This is where the magic of exponential growth happens.

Furthermore, including a small allocation to these high-risk assets can significantly enhance your overall portfolio's potential returns, assuming you've already secured a foundation of large-cap holdings. It's the classic "high risk, high reward" scenario.

Analyzing the Risks: What You Need to Know

Before diving into the pursuit of the Top Low Market Cap Crypto, you must understand the pitfalls. Many of these projects fail, fade away, or turn out to be malicious. Your due diligence must be impeccable.

Common risks associated with low-cap projects include:

- High Volatility: Prices can swing 50% up or down in a single day, or even an hour. This demands emotional resilience and strict risk management.

- Liquidity Issues: It can sometimes be difficult to sell large amounts of the token quickly without crashing the price, especially on decentralized exchanges.

- Rug Pulls and Scams: Unfortunately, bad actors often target the low-cap space. Developers might abandon the project and drain the liquidity pool, leaving investors with worthless tokens.

- Lack of Audits: Smaller projects often skip crucial smart contract audits, leaving them vulnerable to exploits.

Key Metrics to Spot the Next 100x Gem

Identifying the truly promising projects requires looking beyond hype and focusing on fundamental data. While the price might be low, the underlying quality must be high. Here are the core metrics successful low-cap investors prioritize.

Community Strength and Development Activity

In crypto, the community is often the most valuable asset. A project with dedicated, engaged users is far more likely to survive market downturns and attract new investors. Look for active communication channels (Telegram, Discord) and thoughtful discussions, not just meme spam.

Crucially, examine the development activity. A lack of recent commits on GitHub or an absence of roadmap updates suggests the project is stalling. Active developers show commitment and potential for future innovation.

Real-World Utility and Problem Solving

Does the project actually solve a real problem, or is it just a token? The most sustainable investments, including the Top Low Market Cap Crypto contenders, are those providing utility that users genuinely need. This might be a faster payment system, a solution for supply chain logistics, or a unique governance model.

Ask yourself: What is the unique selling proposition (USP)? If the answer is "it's fast and cheap," remember that thousands of other cryptos claim the same thing. Look for specialized niches where blockchain technology provides a clear, measurable advantage over traditional solutions.

Tokenomics: Is the Distribution Fair?

Tokenomics—the structure and economics of the token—is perhaps the most important fundamental metric. Poor tokenomics can doom even the best projects. You need to analyze the supply schedule and distribution method.

Key tokenomic questions to answer:

- Total Supply and Circulating Supply: Is the fully diluted valuation (FDV) reasonable compared to the current circulating supply? Watch out for tokens with massive future unlocks that could flood the market.

- Vesting Schedules: How much of the supply is allocated to founders, early investors, and the team? Are those tokens locked up for a reasonable period (vesting)? If the team can dump their tokens immediately, it's a red flag.

- Allocation to Liquidity: Is enough liquidity locked to prevent massive price manipulation?

- Inflation/Deflation Mechanism: Does the token have a burning mechanism or high inflation rate? Understanding this helps gauge future scarcity.

Finding the Top Low Market Cap Crypto: Tools and Strategies

Success in finding promising low-cap projects is less about luck and more about diligent, structured research. You need reliable tools and a disciplined approach to research.

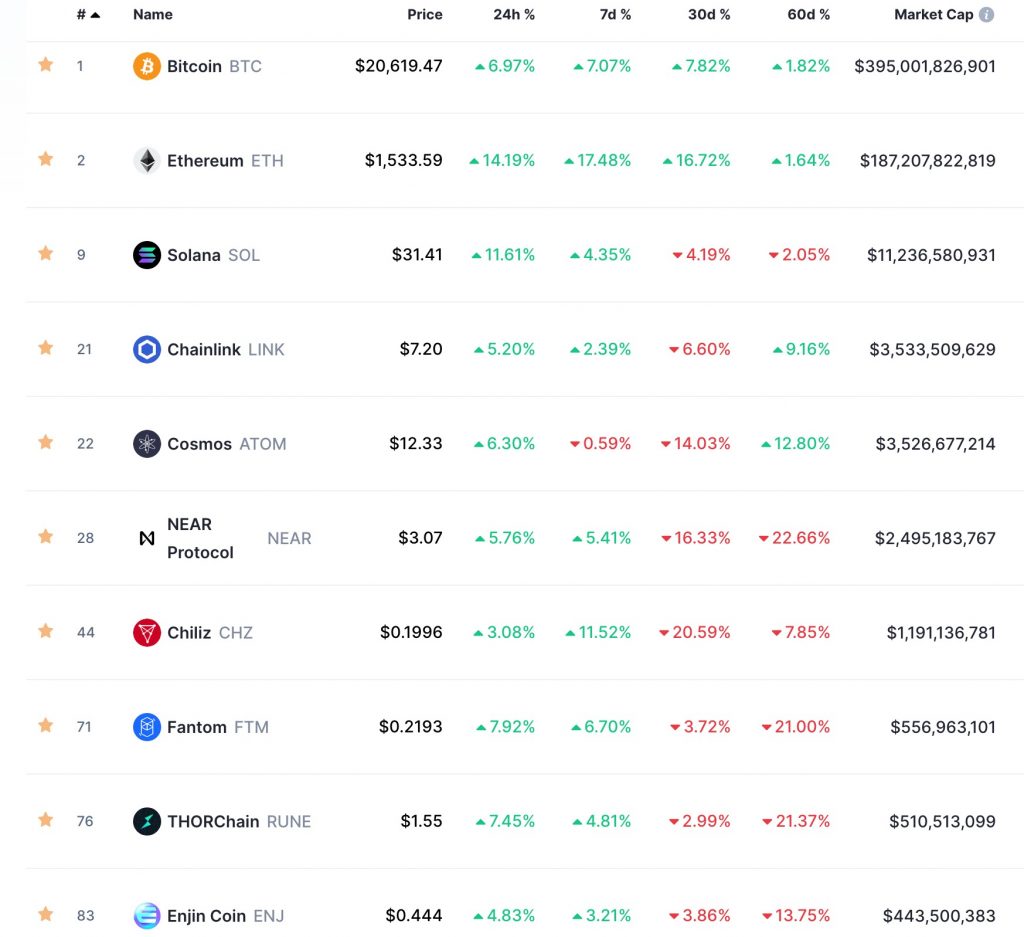

Start by utilizing crypto screeners and data aggregators. Platforms like CoinMarketCap and CoinGecko allow you to filter projects based on market cap, volume, and age. Filter aggressively to find projects that are newly launched but already showing stable volume.

Next, delve into the project documentation. Read the Whitepaper thoroughly. This document should clearly articulate the problem, the solution, the technology, and the tokenomics. If a project lacks a detailed whitepaper, move on.

Finally, utilize blockchain explorers specific to the chain (e.g., Etherscan, BscScan). This allows you to verify the contract legitimacy, check the largest wallet holders (to avoid whale manipulation), and confirm transactions—an essential step for validating the project's claims.

This process is time-consuming, but necessary. Remember, the goal is to be early, and being early requires deeper research than simply looking at the trending lists.

Conclusion: Mastering the Hunt for Low-Cap Opportunities

Investing in the Top Low Market Cap Crypto space is inherently risky but holds the highest potential for life-changing returns. Success requires a blend of cautious optimism and rigorous fundamental analysis.

Always prioritize utility, transparent tokenomics, and an actively engaged development team over short-term price movements or massive marketing budgets. By treating every investment as a potential long-term business venture and diligently studying the core metrics, you significantly increase your odds of uncovering those rare, explosive hidden gems. Remember to never invest more than you are prepared to lose, and happy hunting!

Frequently Asked Questions (FAQ)

- What is considered a "Low Market Cap Crypto"?

- While definitions vary, most investors consider cryptocurrencies with a market capitalization below $50 million, and sometimes even below $10 million, to be low-cap. These figures change depending on whether the market is bullish or bearish.

- How do I avoid rug pulls when looking for Top Low Market Cap Crypto?

- Always check for locked liquidity (verified by third-party services like UniCrypt), look at the wallet distribution (ensuring no single wallet holds a huge percentage), and prioritize projects where the team is doxxed or has a proven track record. If the claims sound too good to be true, they usually are.

- Is Low Market Cap Crypto only available on decentralized exchanges (DEX)?

- Initially, yes. New projects often launch on DEXs like Uniswap or PancakeSwap. However, if a project gains significant traction and becomes a candidate for the Top Low Market Cap Crypto list, it will usually aim for listing on major centralized exchanges (CEXs) like KuCoin or Binance, which often drives the next wave of price appreciation.

- What percentage of my portfolio should I allocate to high-risk low-cap coins?

- This depends entirely on your risk tolerance. Financial advisors typically recommend allocating only a small percentage—often 5% to 10%—of your total crypto portfolio to high-risk, low-cap projects, ensuring the majority of your funds are in stable, established assets.

Top Low Market Cap Crypto

Top Low Market Cap Crypto Wallpapers

Collection of top low market cap crypto wallpapers for your desktop and mobile devices.

Serene Top Low Market Cap Crypto Design Illustration

Experience the crisp clarity of this stunning top low market cap crypto image, available in high resolution for all your screens.

Breathtaking Top Low Market Cap Crypto Landscape Illustration

Transform your screen with this vivid top low market cap crypto artwork, a true masterpiece of digital design.

Spectacular Top Low Market Cap Crypto Abstract Illustration

A captivating top low market cap crypto scene that brings tranquility and beauty to any device.

Breathtaking Top Low Market Cap Crypto Moment for Your Screen

Explore this high-quality top low market cap crypto image, perfect for enhancing your desktop or mobile wallpaper.

Serene Top Low Market Cap Crypto Picture Photography

Experience the crisp clarity of this stunning top low market cap crypto image, available in high resolution for all your screens.

High-Quality Top Low Market Cap Crypto Moment Collection

Discover an amazing top low market cap crypto background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Stunning Top Low Market Cap Crypto View Photography

Immerse yourself in the stunning details of this beautiful top low market cap crypto wallpaper, designed for a captivating visual experience.

Gorgeous Top Low Market Cap Crypto Picture Art

Immerse yourself in the stunning details of this beautiful top low market cap crypto wallpaper, designed for a captivating visual experience.

Captivating Top Low Market Cap Crypto Scene in HD

Find inspiration with this unique top low market cap crypto illustration, crafted to provide a fresh look for your background.

Amazing Top Low Market Cap Crypto Artwork for Desktop

Explore this high-quality top low market cap crypto image, perfect for enhancing your desktop or mobile wallpaper.

Vivid Top Low Market Cap Crypto Background for Mobile

Explore this high-quality top low market cap crypto image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful Top Low Market Cap Crypto Wallpaper Nature

Experience the crisp clarity of this stunning top low market cap crypto image, available in high resolution for all your screens.

Mesmerizing Top Low Market Cap Crypto Artwork for Your Screen

Experience the crisp clarity of this stunning top low market cap crypto image, available in high resolution for all your screens.

High-Quality Top Low Market Cap Crypto Moment for Desktop

Transform your screen with this vivid top low market cap crypto artwork, a true masterpiece of digital design.

Artistic Top Low Market Cap Crypto Abstract Photography

Immerse yourself in the stunning details of this beautiful top low market cap crypto wallpaper, designed for a captivating visual experience.

Captivating Top Low Market Cap Crypto Wallpaper for Your Screen

A captivating top low market cap crypto scene that brings tranquility and beauty to any device.

.png)

Gorgeous Top Low Market Cap Crypto View for Your Screen

A captivating top low market cap crypto scene that brings tranquility and beauty to any device.

Beautiful Top Low Market Cap Crypto View for Desktop

Transform your screen with this vivid top low market cap crypto artwork, a true masterpiece of digital design.

Serene Top Low Market Cap Crypto Moment in 4K

Experience the crisp clarity of this stunning top low market cap crypto image, available in high resolution for all your screens.

Mesmerizing Top Low Market Cap Crypto Background Collection

Discover an amazing top low market cap crypto background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Download these top low market cap crypto wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Top Low Market Cap Crypto"

Post a Comment