Crypto With Low Market Cap

Crypto With Low Market Cap: Unearthing Hidden Gems in the Digital Wild West

Are you tired of chasing Bitcoin and Ethereum, feeling like you missed the boat on massive gains? If you are looking for those truly life-changing investments in the decentralized world, you likely need to shift your focus away from the mega-caps and dive into the exciting, yet volatile, world of Crypto With Low Market Cap. These are the digital assets that haven't hit the mainstream yet, offering immense upside potential but carrying significantly higher risk.

This comprehensive guide will walk you through everything you need to know about navigating the low cap crypto landscape. We will discuss how to identify potential winners, understand the inherent risks, and ultimately build a strategy to find those hidden gems before everyone else does. Prepare your research tools; the hunt for the next 100x moonshot begins now!

What Exactly is a Crypto With Low Market Cap?

In simple terms, a crypto's market cap is calculated by multiplying its current price by the total number of coins or tokens in circulation. This figure provides a clear picture of the network's total value. When we talk about a Crypto With Low Market Cap, we are generally referring to tokens that fall below a certain threshold, often far less than $100 million.

While definitions can vary depending on the market cycle, low cap coins typically fall into categories like micro-caps (under $50 million) or even nano-caps (under $10 million). Compared to giants like BTC or ETH, which boast market caps in the hundreds of billions, these smaller projects are still in their infancy. Therefore, even small amounts of investment or negative news can drastically affect their price, creating massive volatility.

Understanding this size difference is crucial. A $10 million coin only needs $10 million in fresh capital to double its value (a 100% gain). In contrast, Bitcoin requires hundreds of billions for the same percentage movement. This mathematical reality is the primary driver behind the massive potential returns often associated with these nascent assets.

Why Investors Are Obsessed with Low Cap Crypto (The Appeal)

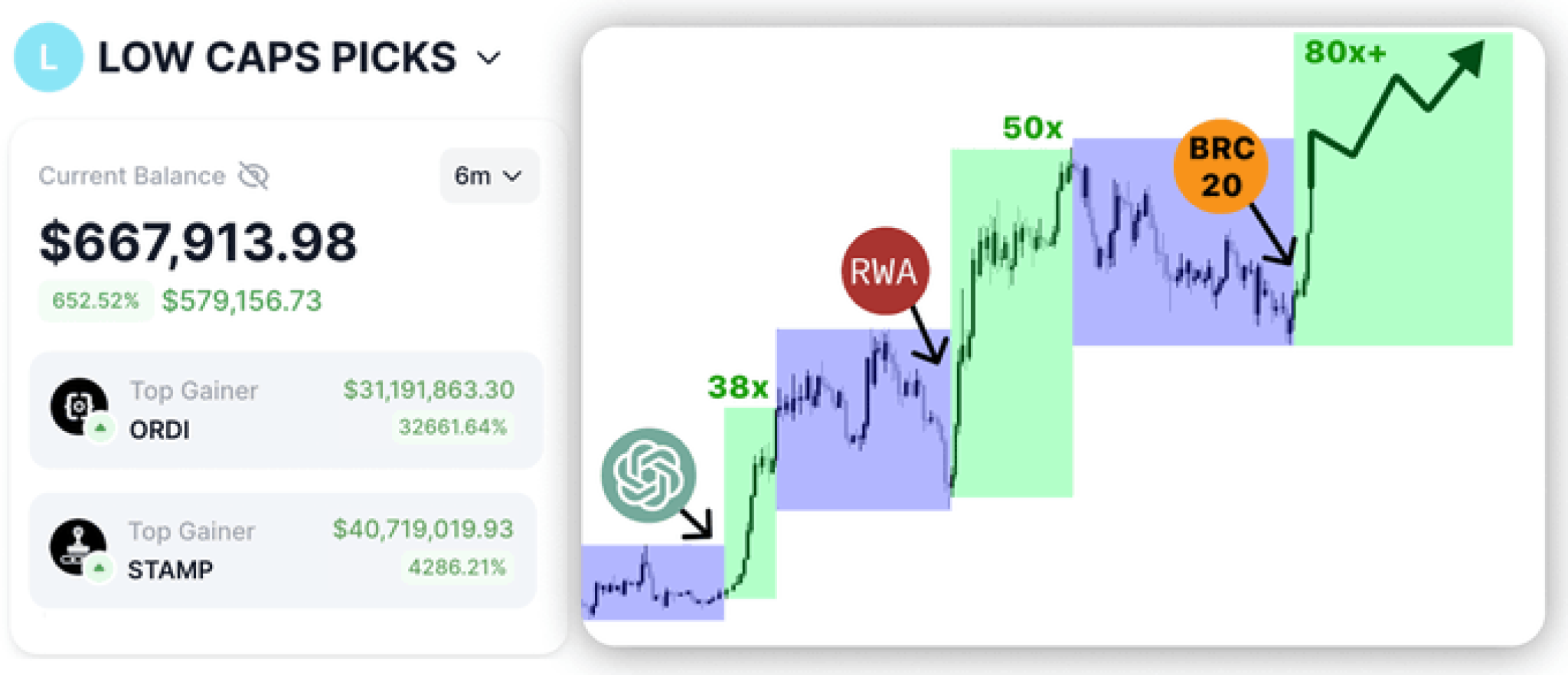

The main reason investors flock to Crypto With Low Market Cap is the pursuit of outsized returns. While traditional investments might offer 8-15% annually, low cap crypto promises the potential for 10x, 50x, or even 100x returns during a bullish cycle. This possibility of exponential growth is hard to ignore, especially for those who missed the earlier crypto booms.

Furthermore, investing in low cap projects means you are often backing truly innovative ideas. Many of these projects are exploring niche areas of blockchain technology, such as specialized DeFi protocols, unique metaverse experiences, or groundbreaking layer-2 scaling solutions. You are not just buying a coin; you are investing in the potential future infrastructure of the internet.

The Allure of 100x Potential

The dream of turning a small investment into a substantial fortune is very real in the low cap sector. This potential is purely mathematical, as explained earlier. If a small, well-developed project gains traction, lists on major exchanges, and solves a real-world problem, its valuation can explode overnight. However, it is essential to remember that for every 100x winner, there are hundreds of projects that fade away.

Successful investors in this sector treat it almost like venture capital. They understand that most of their small investments will fail, but the one or two that succeed wildly will cover all the losses and provide massive profit margins. Therefore, proper position sizing and risk management are absolutely critical when engaging with tokens promising this level of return.

Early Adoption and Community Influence

Getting involved early with a Crypto With Low Market Cap also offers a unique opportunity to influence its development. Unlike established behemoths, these smaller projects often rely heavily on their early community members for feedback, testing, and promotion.

Being an early adopter means you can often participate in staking programs, governance decisions, and unique airdrops that incentivize commitment. This sense of ownership and involvement creates a powerful, dedicated community, which is often a strong indicator of a project's future success. A thriving, engaged community is a prerequisite for any low cap coin hoping to escape micro-cap status.

Navigating the High-Risk Waters: Things You Must Know

While the rewards are tempting, it would be irresponsible not to address the severe risks associated with these volatile assets. Investing in a Crypto With Low Market Cap is akin to gambling if you don't approach it with a strict, research-focused mindset. The risks are magnified due to low liquidity and a lack of regulatory oversight.

Always remember the golden rule of low cap investing: only invest what you can comfortably afford to lose entirely. This ensures that a sudden price crash or a project failure does not jeopardize your financial stability.

Key Risks Associated with Low Cap Coins

Before putting any capital into this sector, you must be aware of the primary dangers lurking in the low cap space:

- Low Liquidity: Because trading volume is low, it can be incredibly difficult to sell your tokens quickly without crashing the price further. This lack of liquidity means you might be stuck holding the bag during a market downturn.

- Rug Pulls and Scams: Unfortunately, the barrier to entry for launching a new token is low. Many projects are simply designed to steal investor funds (known as "rug pulls"). The development team might suddenly abandon the project or drain the liquidity pool after funds are raised.

- Extreme Volatility: Price swings of 50% in a single day are common, both up and down. Psychological resilience is required to handle these drastic movements without making impulsive trading decisions.

- Development Risk: Many low cap projects never manage to deliver on their ambitious whitepaper promises. Technical difficulties, lack of funding, or team disputes can cause a project to stall indefinitely.

Due Diligence Checklist Before Investing

To mitigate these risks, conducting thorough research—often called Due Diligence (DD)—is non-negotiable. Don't rely solely on hype from social media influencers. Instead, focus on these objective factors:

- Audit and Security: Has the smart contract code been audited by a reputable third-party firm (like CertiK or PeckShield)? An unverified contract is a massive red flag.

- The Team and Roadmap: Are the team members publicly known (doxxed)? Do they have a verifiable history in crypto or tech? Does the roadmap make sense, and are they consistently meeting their milestones?

- Tokenomics and Vesting: How are the tokens distributed? Is a large percentage held by the developers or a few early investors? Look for clear vesting schedules that prevent founders from dumping millions of tokens onto the market prematurely.

- Real-World Utility: Does the project solve a genuine problem, or is it merely a speculative currency? Genuine utility is the foundation for long-term growth and adoption.

Tips for Finding the Next Big Crypto With Low Market Cap

Finding a successful Crypto With Low Market Cap requires detective work. Here are some actionable steps you can take to stay ahead of the curve:

- Explore Emerging Ecosystems: Instead of focusing only on Ethereum, look for projects on newer, less congested chains like Solana, Avalanche, or Polygon. Early tokens on these platforms often have more room to grow.

- Use On-Chain Analytics: Learn to use block explorers and DEX monitoring tools to track where large wallet addresses (whales) are moving their funds. Following smart money can give you a significant edge.

- Monitor Launchpads and IDOs: Initial DEX Offerings (IDOs) and token launch platforms vet new projects before they go public. Getting early access through these platforms can be highly rewarding, though often competitive.

- Dive Deep into Crypto Communities: Spend time on platforms like Discord and Telegram where core enthusiasts and developers congregate. Listen to the genuine chatter and filter out the noise and pure promotion.

Conclusion

Investing in a Crypto With Low Market Cap is not for the faint of heart, but it remains one of the few areas where retail investors can still achieve truly astronomical returns. By applying rigorous due diligence, prioritizing security audits, and carefully managing your risk exposure, you can position yourself to benefit when one of these hidden gems finally breaks into the mainstream.

Remember, success in this volatile sector is about diversification and patience. Treat it as a marathon, not a sprint, and never underestimate the value of thorough research. Happy hunting!

Frequently Asked Questions (FAQ) About Low Cap Crypto

- What is considered a "low market cap" in crypto?

- While there is no universally fixed number, a crypto asset is generally considered to have a low market cap if its total valuation is below $100 million. Many truly high-potential coins often start below the $10 million mark.

- Is it safe to invest in low cap crypto?

- Safety is relative. Low cap crypto carries significantly higher risk than blue-chip assets like Bitcoin or established stocks. Risks include sudden liquidity withdrawal, scams (rug pulls), and extreme volatility. It is only safe if you employ strict risk management and only invest disposable income.

- How can I identify a potential rug pull?

- Red flags for rug pulls include an anonymous team, no security audit, extremely high APY (annual percentage yield) promises, vague whitepapers, and tokenomics that show a very high concentration of tokens held by the development wallet.

- Where can I buy a Crypto With Low Market Cap?

- Most low cap cryptos are initially traded on decentralized exchanges (DEXs) like Uniswap (Ethereum) or PancakeSwap (BNB Chain). Once they grow, they may be listed on smaller centralized exchanges (CEXs) before making it to major platforms like Binance or Coinbase.

Crypto With Low Market Cap

Crypto With Low Market Cap Wallpapers

Collection of crypto with low market cap wallpapers for your desktop and mobile devices.

Vibrant Crypto With Low Market Cap Abstract Photography

Transform your screen with this vivid crypto with low market cap artwork, a true masterpiece of digital design.

Captivating Crypto With Low Market Cap Scene in HD

Find inspiration with this unique crypto with low market cap illustration, crafted to provide a fresh look for your background.

Artistic Crypto With Low Market Cap Scene for Your Screen

Immerse yourself in the stunning details of this beautiful crypto with low market cap wallpaper, designed for a captivating visual experience.

Captivating Crypto With Low Market Cap Wallpaper for Your Screen

A captivating crypto with low market cap scene that brings tranquility and beauty to any device.

High-Quality Crypto With Low Market Cap Image for Desktop

Explore this high-quality crypto with low market cap image, perfect for enhancing your desktop or mobile wallpaper.

Serene Crypto With Low Market Cap Design Illustration

Experience the crisp clarity of this stunning crypto with low market cap image, available in high resolution for all your screens.

Lush Crypto With Low Market Cap Design Photography

This gorgeous crypto with low market cap photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Beautiful Crypto With Low Market Cap Wallpaper Nature

Experience the crisp clarity of this stunning crypto with low market cap image, available in high resolution for all your screens.

Exquisite Crypto With Low Market Cap Artwork Nature

This gorgeous crypto with low market cap photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Lush Crypto With Low Market Cap View Photography

A captivating crypto with low market cap scene that brings tranquility and beauty to any device.

Detailed Crypto With Low Market Cap Picture Photography

Discover an amazing crypto with low market cap background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Stunning Crypto With Low Market Cap Background Concept

Find inspiration with this unique crypto with low market cap illustration, crafted to provide a fresh look for your background.

High-Quality Crypto With Low Market Cap Moment Collection

Discover an amazing crypto with low market cap background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vibrant Crypto With Low Market Cap View Nature

Experience the crisp clarity of this stunning crypto with low market cap image, available in high resolution for all your screens.

Stunning Crypto With Low Market Cap View Photography

Immerse yourself in the stunning details of this beautiful crypto with low market cap wallpaper, designed for a captivating visual experience.

Lush Crypto With Low Market Cap View for Your Screen

This gorgeous crypto with low market cap photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Mesmerizing Crypto With Low Market Cap Artwork for Your Screen

Experience the crisp clarity of this stunning crypto with low market cap image, available in high resolution for all your screens.

Dynamic Crypto With Low Market Cap Design Digital Art

A captivating crypto with low market cap scene that brings tranquility and beauty to any device.

Stunning Crypto With Low Market Cap Background Illustration

Find inspiration with this unique crypto with low market cap illustration, crafted to provide a fresh look for your background.

Stunning Crypto With Low Market Cap Scene Photography

This gorgeous crypto with low market cap photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Download these crypto with low market cap wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Crypto With Low Market Cap"

Post a Comment