Crypto List Market Cap

Crypto List Market Cap: Your Ultimate Guide to Understanding the Digital Money Hierarchy

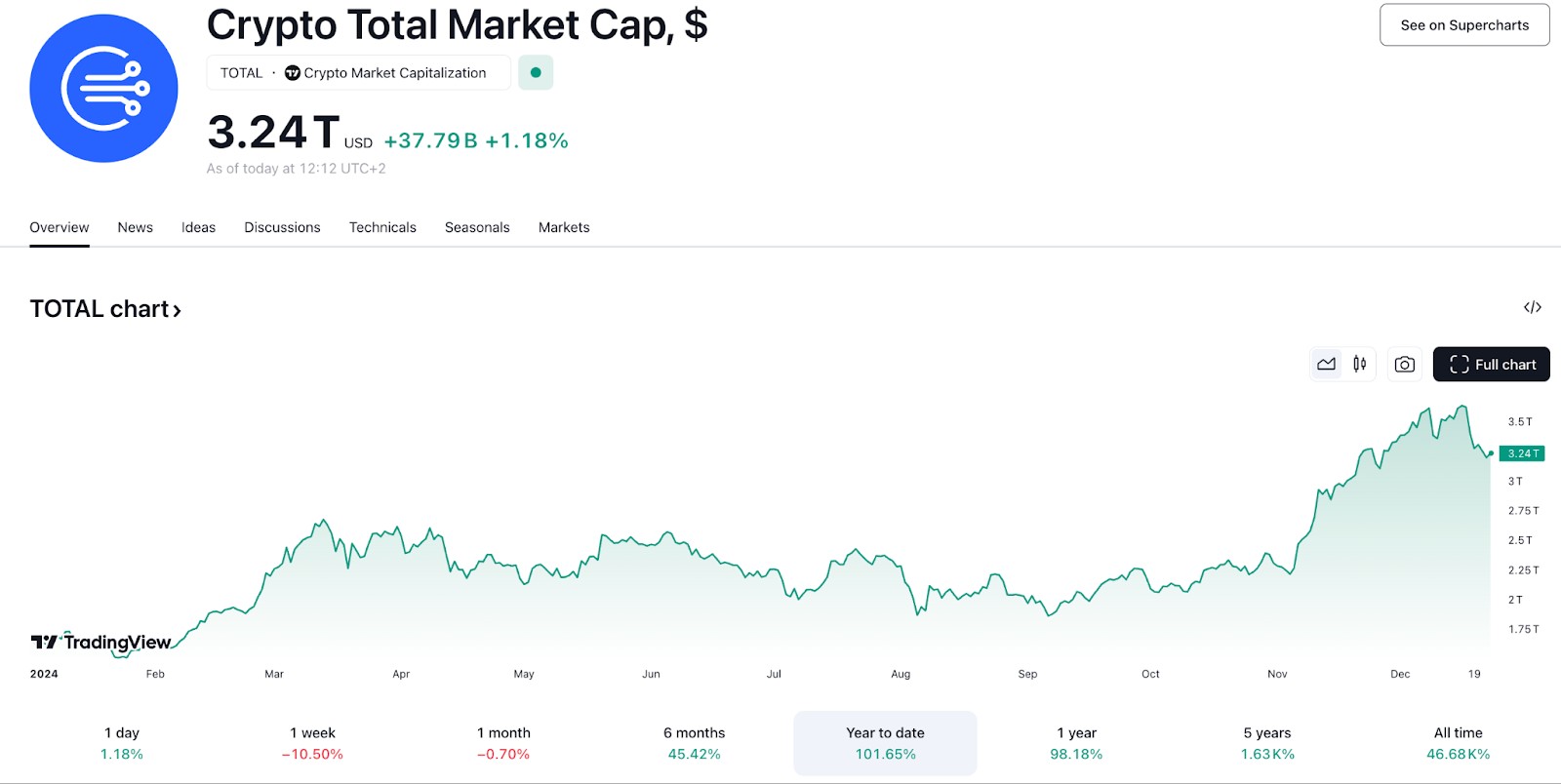

Hey there! If you're diving into the exciting world of digital assets, you've probably seen charts and lists dominated by one crucial metric: Market Capitalization. Understanding the Crypto List Market Cap isn't just about crunching numbers; it's about grasping the overall standing, stability, and growth potential of every coin out there.

Think of it as the scoreboard for the cryptocurrency world. This figure is fundamental for both seasoned traders and curious newcomers. We're going to break down exactly what this number means, why it matters for your investment decisions, and how to use those rankings effectively.

Ready to look beyond the price tag? Let's jump in and demystify the hierarchy of digital currencies.

What Exactly is the Crypto List Market Cap?

At its core, Market Capitalization (or Market Cap) is the total dollar value of all the coins or tokens that have been mined or are currently in circulation for a specific cryptocurrency. It provides a much clearer picture of a crypto's size compared to just looking at its unit price.

For example, a project might have a low unit price but a massive supply, resulting in a high market cap. Conversely, a coin with a very high unit price but a tiny circulating supply might have a surprisingly low market cap.

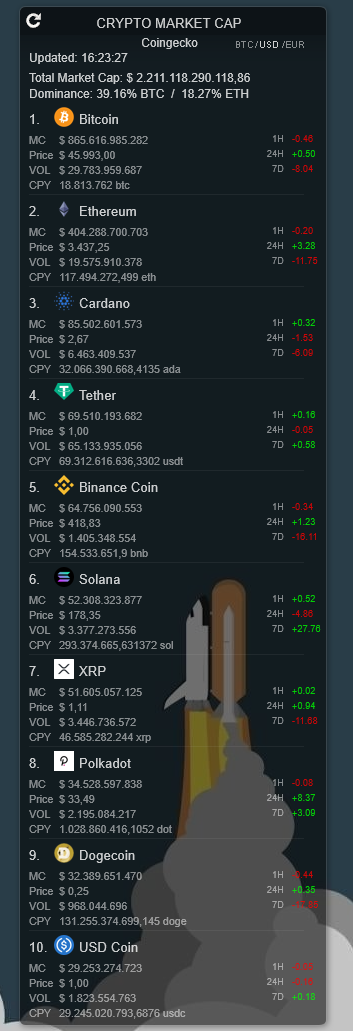

When you look at the master Crypto List Market Cap, you are essentially viewing an aggregation of these values, ranked from the largest (usually Bitcoin) down to the smallest micro-cap coins. This ranking instantly tells you which assets dominate the overall market.

Why Does the Crypto List Market Cap Matter for Investors?

Market Cap is one of the primary indicators of stability and perceived value in the crypto world. Investors use this metric to quickly assess risk.

Generally speaking, the higher the Market Cap, the more stable the asset is considered to be. Massive crypto assets are less volatile because it requires huge amounts of capital to move their price significantly.

Furthermore, the Crypto List Market Cap helps investors benchmark different assets against one another. It allows for a standardized comparison, helping you decide whether you want to chase potential high rewards (smaller caps) or prioritize safety and established infrastructure (larger caps).

How Market Cap is Calculated: Simple Math, Big Implications

The calculation is surprisingly straightforward, relying on just two key variables. However, understanding how exchanges derive these numbers is essential for accurate analysis.

Here is the basic formula used by major data aggregators:

- **Current Price:** Determine the last traded price of the cryptocurrency (usually in USD or a local fiat currency).

- **Circulating Supply:** Find the total number of coins that have been released and are actively available to the public. This excludes coins that are burned, locked up, or un-mined.

- **The Calculation:** Multiply the Current Price by the Circulating Supply.

For instance, if Coin X costs $50 and there are 10 million coins in circulation, its Market Cap is $500 million. This simplicity allows the Crypto List Market Cap to be updated in real-time across various tracking websites.

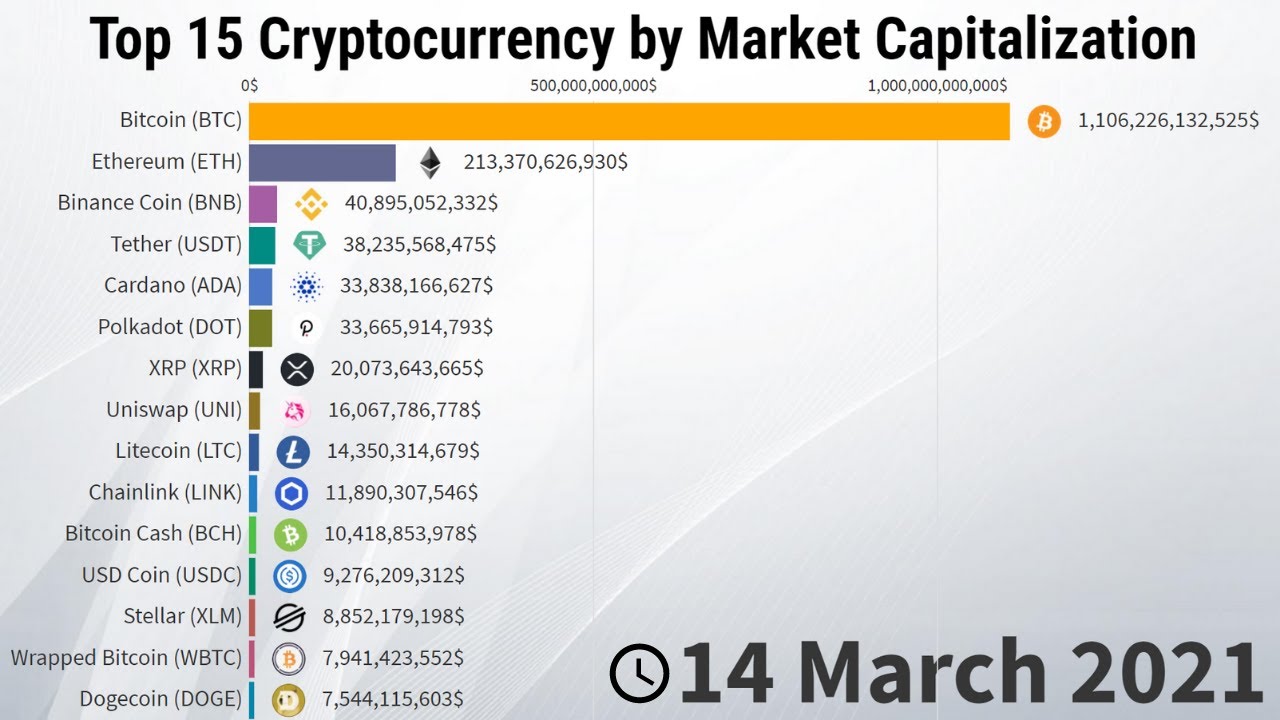

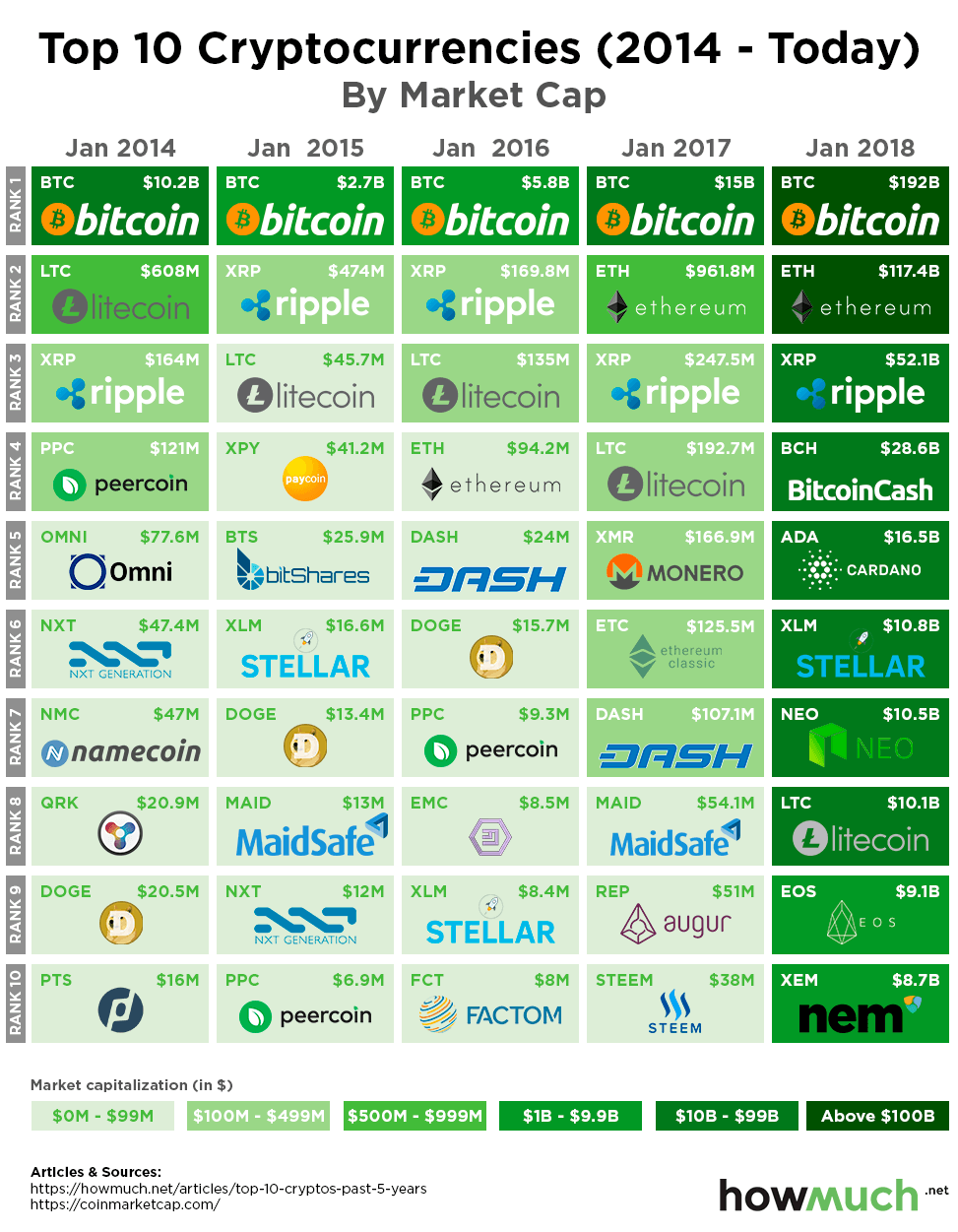

Navigating the Top Crypto List Market Cap Rankings

When you pull up any list of cryptocurrencies, you'll notice the rankings rarely change dramatically day-to-day, especially at the very top. This consistency is a reflection of the network effects, liquidity, and general confidence surrounding these projects.

The top ranks are fiercely competitive, and while new projects occasionally climb into the top 20, breaking into the top 5 is incredibly rare and usually signifies a massive shift in market sentiment or regulatory acceptance.

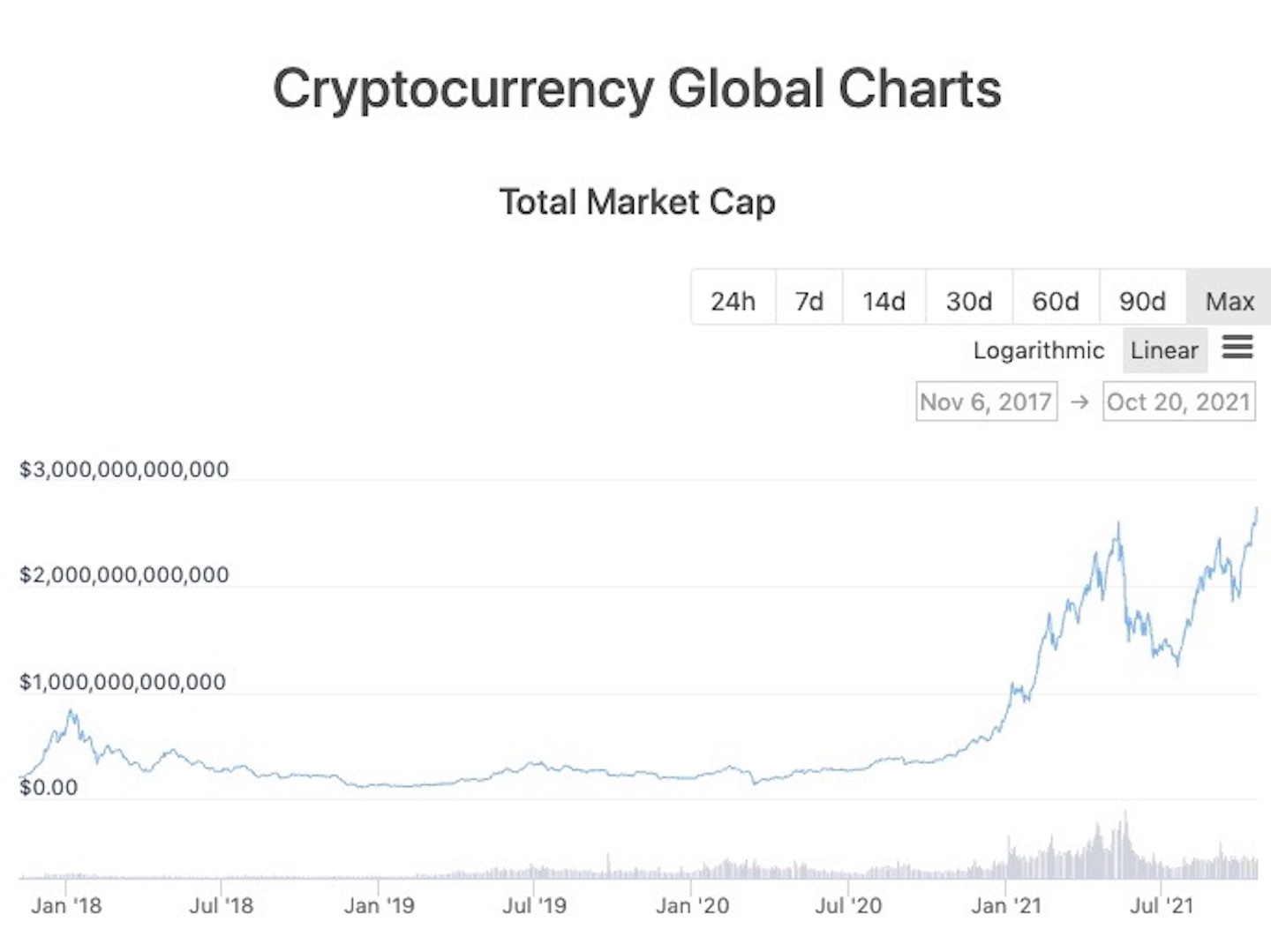

Looking at the full Crypto List Market Cap gives you immediate context. Are the top 10 coins consolidating their dominance, or are we seeing a rotation of capital into riskier, smaller assets? These rankings are a daily snapshot of the global crypto consensus.

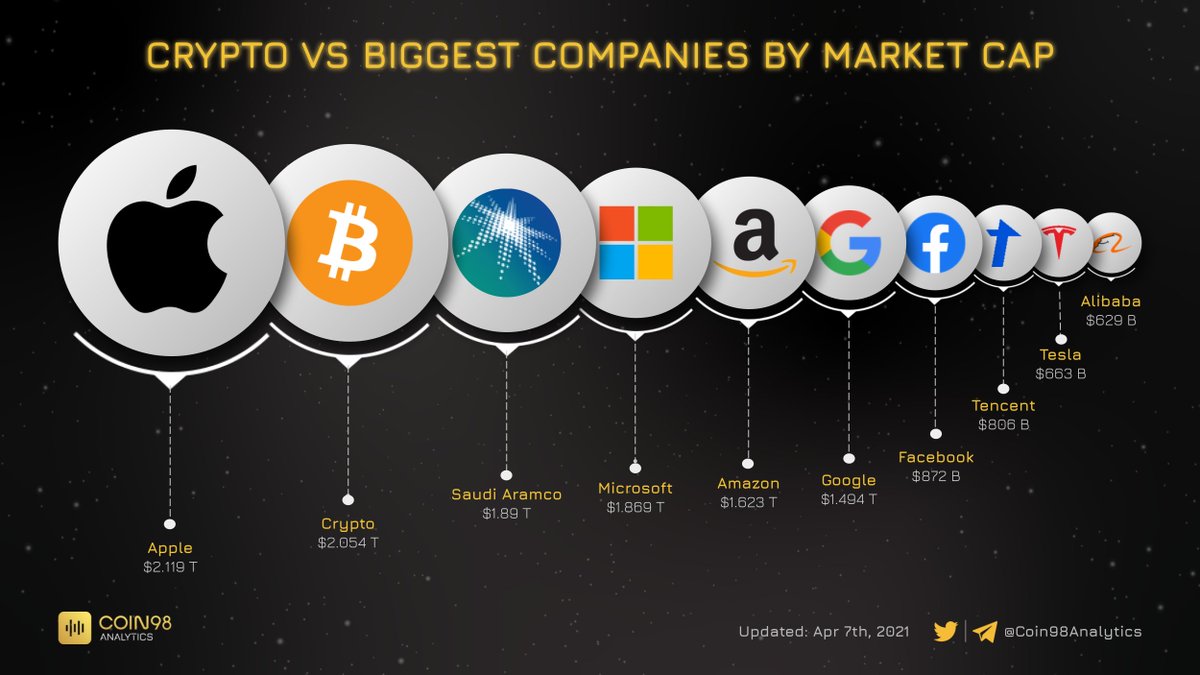

The Big Players: Bitcoin, Ethereum, and the Dominance Factor

Bitcoin (BTC) and Ethereum (ETH) traditionally anchor the top of the Market Cap list. Their sheer size often dictates the overall movement of the entire crypto space—a concept known as "dominance."

Bitcoin dominance, for instance, refers to Bitcoin's Market Cap relative to the total Market Cap of the entire crypto market. When BTC dominance rises, it often means capital is flowing out of altcoins and into Bitcoin for safety, or during the initial phase of a bull run.

These large-cap coins offer specific advantages to investors focused on minimizing short-term risk:

- High Liquidity: Easier to buy and sell large quantities without significant price impact.

- Established Networks: Years of operation and proven security track records.

- Institutional Interest: Often the first and only crypto assets approved for traditional investment vehicles like ETFs.

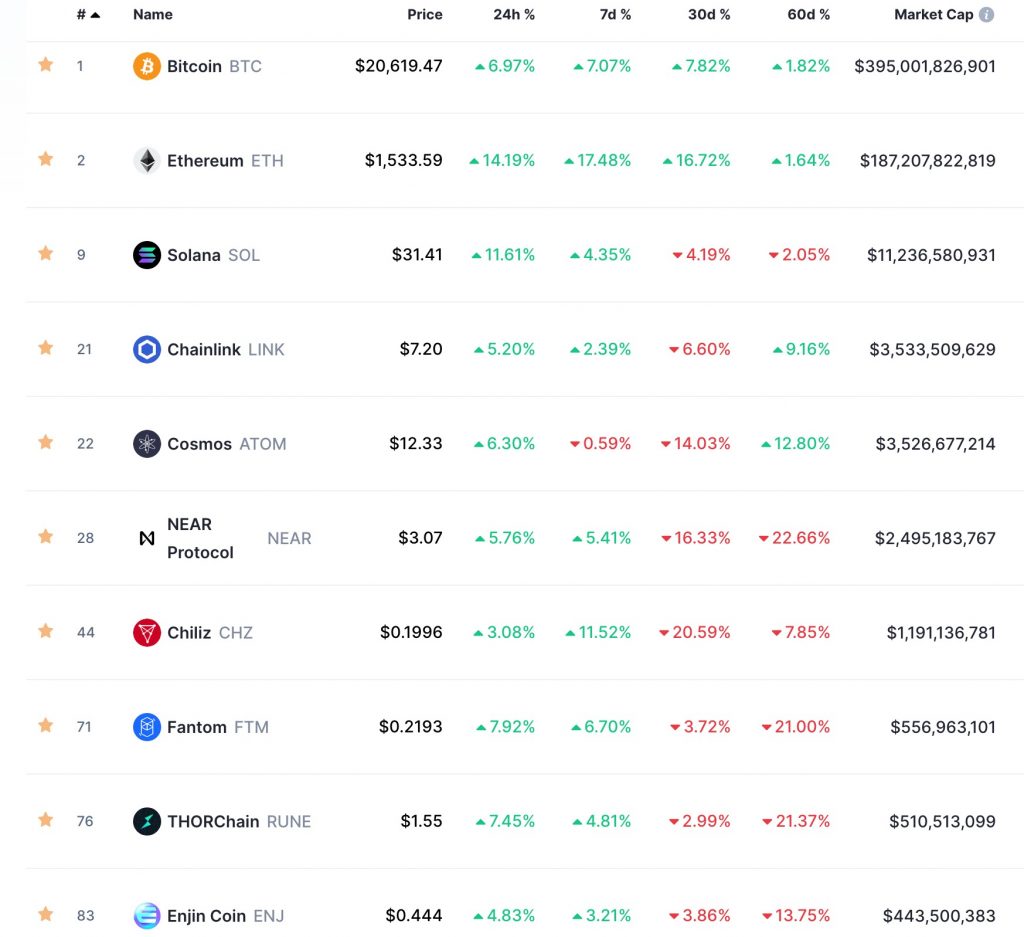

Recognizing the Difference: Market Cap vs. Trading Volume

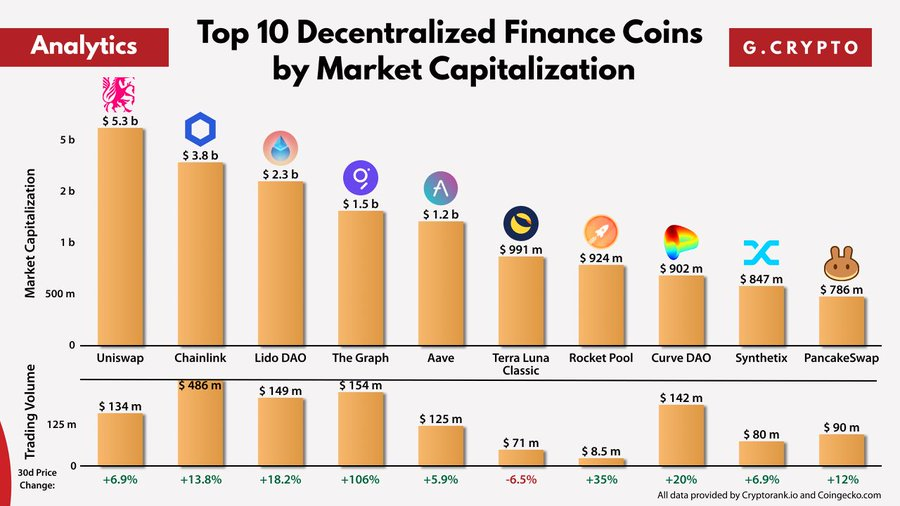

When analyzing the Crypto List Market Cap, it's vital not to confuse Market Cap with trading volume. They measure two completely different aspects of an asset, yet they are both crucial metrics for traders.

Market Cap tells you the total value of the network, which is a static snapshot (though constantly updating). Volume, on the other hand, tells you how much of the asset has been bought and sold within a specific period (usually the last 24 hours).

High trading volume alongside a strong Market Cap suggests high interest and liquidity. However, if you see a small Market Cap coin suddenly jump with huge volume, this could signal an upcoming price pump or major news event.

Using the Crypto List Market Cap in Your Investment Strategy

Effective investment strategies almost always involve a balanced portfolio structured around different Market Cap sizes. You shouldn't put all your eggs in the Bitcoin basket, but ignoring the top of the list would be risky.

Your Market Cap analysis should align with your risk tolerance. Do you prefer steady growth, or are you hunting for that elusive 100x return? The answer helps determine which tier of the Crypto List Market Cap you should focus on.

Remember that diversification across these categories helps hedge against risk. A drop in one small-cap project won't derail your entire portfolio if you are well-positioned in larger, more stable assets.

Analyzing Different Market Cap Categories

The crypto market is generally segmented into three major categories based on Market Cap. While the exact dollar thresholds shift with market cycles, their characteristics remain consistent:

1. Large-Cap Cryptos (Often >$10 Billion): These include Bitcoin, Ethereum, and other well-established projects. They are the market leaders, highly liquid, and generally offer lower volatility. They are suitable for investors prioritizing capital preservation and moderate growth.

2. Mid-Cap Cryptos (Often $1 Billion to $10 Billion): These coins are often newer, disruptive projects that have already gained traction but are not yet fully matured. They offer a balance between high growth potential and moderate risk compared to large caps.

3. Small-Cap Cryptos (Often <$1 Billion): These are the highest-risk, highest-reward assets. They include new DeFi projects, obscure tokens, and early-stage ventures. While they can deliver astronomical returns, they are extremely volatile and lack significant liquidity.

Common Pitfalls When Relying Solely on the Crypto List Market Cap

While the Market Cap is a powerful metric, it's not the only factor you should consider. Over-reliance on this single data point can lead to poor investment decisions, particularly due to the unique characteristics of crypto assets.

A key issue is "diluted Market Cap," which sometimes includes coins not yet in circulation. Furthermore, fake trading volume (wash trading) can sometimes artificially inflate the perceived value and movement of a coin.

Always remember to investigate the technology, the development team, the community engagement, and the tokenomics (how the supply is managed) of any project, regardless of its ranking on the Crypto List Market Cap.

Conclusion: Mastering the Crypto List Market Cap

The Crypto List Market Cap serves as the fundamental organizational tool for navigating the cryptocurrency universe. It allows you to quickly gauge the scale, maturity, and stability of an asset.

By understanding how Market Cap is calculated and how to analyze the differences between large, mid, and small-cap assets, you can build a more informed and risk-adjusted investment strategy. Never use Market Cap in isolation, but recognize it as the essential starting point for your research.

Now that you have this knowledge, you are better equipped to read the crypto market like a pro and make smarter decisions for your digital portfolio. Happy investing!

Frequently Asked Questions (FAQ) About Crypto Market Cap

- What is the difference between Market Cap and Fully Diluted Market Cap?

- Market Cap uses the current circulating supply. Fully Diluted Market Cap (FDMC) estimates the total value if all possible coins (including those yet to be mined or released) were in circulation at the current price. FDMC can be very important for new tokens with low current supply.

- Is a high Crypto List Market Cap always better?

- Not always "better," but generally safer. High Market Cap means more stability and liquidity, suitable for capital preservation. Low Market Cap means higher volatility and potential exponential growth, but also much higher risk of failure.

- How often does the Crypto List Market Cap change?

- The Market Cap calculation is dependent on the coin's price, which changes second-by-second based on trading activity. Therefore, the Market Cap itself is constantly changing and being updated in real-time by data aggregators.

- Why are Stablecoins (like USDT or USDC) always near the top of the Crypto List Market Cap?

- Stablecoins are designed to maintain a 1:1 value with a fiat currency (usually USD). Their Market Cap represents the total amount of money collateralizing those stablecoins in circulation, reflecting their massive utility for trading and cross-border transactions.

Crypto List Market Cap

Crypto List Market Cap Wallpapers

Collection of crypto list market cap wallpapers for your desktop and mobile devices.

Spectacular Crypto List Market Cap Capture Nature

Immerse yourself in the stunning details of this beautiful crypto list market cap wallpaper, designed for a captivating visual experience.

Captivating Crypto List Market Cap View for Your Screen

A captivating crypto list market cap scene that brings tranquility and beauty to any device.

Detailed Crypto List Market Cap Moment Art

Transform your screen with this vivid crypto list market cap artwork, a true masterpiece of digital design.

.png)

Gorgeous Crypto List Market Cap View for Your Screen

A captivating crypto list market cap scene that brings tranquility and beauty to any device.

Detailed Crypto List Market Cap View for Mobile

Discover an amazing crypto list market cap background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Serene Crypto List Market Cap Design Illustration

Experience the crisp clarity of this stunning crypto list market cap image, available in high resolution for all your screens.

Exquisite Crypto List Market Cap Photo Concept

This gorgeous crypto list market cap photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing Crypto List Market Cap Artwork in 4K

Explore this high-quality crypto list market cap image, perfect for enhancing your desktop or mobile wallpaper.

Detailed Crypto List Market Cap Capture Art

Explore this high-quality crypto list market cap image, perfect for enhancing your desktop or mobile wallpaper.

Mesmerizing Crypto List Market Cap Background Collection

Discover an amazing crypto list market cap background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp Crypto List Market Cap Artwork in 4K

A captivating crypto list market cap scene that brings tranquility and beauty to any device.

Stunning Crypto List Market Cap Scene Photography

This gorgeous crypto list market cap photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Serene Crypto List Market Cap Scene Art

Explore this high-quality crypto list market cap image, perfect for enhancing your desktop or mobile wallpaper.

Serene Crypto List Market Cap Moment Concept

Explore this high-quality crypto list market cap image, perfect for enhancing your desktop or mobile wallpaper.

Crisp Crypto List Market Cap Design Illustration

Immerse yourself in the stunning details of this beautiful crypto list market cap wallpaper, designed for a captivating visual experience.

Spectacular Crypto List Market Cap Abstract for Your Screen

Find inspiration with this unique crypto list market cap illustration, crafted to provide a fresh look for your background.

Dynamic Crypto List Market Cap Wallpaper Illustration

Immerse yourself in the stunning details of this beautiful crypto list market cap wallpaper, designed for a captivating visual experience.

Exquisite Crypto List Market Cap Moment in HD

A captivating crypto list market cap scene that brings tranquility and beauty to any device.

Spectacular Crypto List Market Cap Artwork Concept

This gorgeous crypto list market cap photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Stunning Crypto List Market Cap Background in HD

Find inspiration with this unique crypto list market cap illustration, crafted to provide a fresh look for your background.

Download these crypto list market cap wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Crypto List Market Cap"

Post a Comment